Introduction

For UK nationals living in or moving to Spain, managing currency exchange and money transfers is a crucial part of adapting to life abroad. Whether you’re purchasing property, transferring pensions, or covering daily expenses, working with a forex broker offers significant advantages over traditional banks or online platforms. In this article, we explain why choosing top forex brokers is essential for UK expats in Spain and how they deliver value through better rates, faster service, and expert advice.

Article Summary

Navigating currency exchange in Spain can feel overwhelming, but this guide simplifies the process. We highlight why choosing a reputable currency broker matters, how to identify reliable services and key benefits brokers offer over banks. You’ll also find actionable tips for locating the best currency exchange near me, whether you are exchanging small amounts regularly or making one-time large transfers, such as buying property or managing investments. With insights into FCA regulation, low fees, competitive rates and advanced tools like forward contracts, this article equips you with the knowledge to make informed decisions and maximize your financial potential.

For British expats living in Spain or planning to relocate, we emphasize the importance of seeking professional advice for foreign exchange and money transfers. Working with a trusted broker ensures seamless and cost-effective transactions. By the end of this guide, you will have a clear understanding of how to find the best currency exchange services in Spain and why partnering with experts can save you time, stress and money.

Key Takeaways

Here’s what you need to know to get the best euro currency exchange near me in Spain:

-

Compare Rates and Fees: Always compare rates and fees from multiple providers to secure the best deal.

-

Choose FCA-Regulated Brokers: Ensure your forex broker is authorized by financial authorities for secure and reliable transactions.

-

Prioritize Low Fees and Transparent Costs: Avoid hidden charges that can eat into your currency exchange value.

-

Use Value-Added Tools: Features like forward contracts and rate tracking help you lock in favourable rates and reduce risks.

-

Work With Experts: Trusted brokers offer better rates and personalized strategies compared to banks or exchange centers.

-

Plan Ahead: For large transactions like property purchases or regular payments, working with a forex broker ensures stability and cost savings.

Take these steps to secure the best currency exchange near you in Spain and maximize your financial potential.

Why Choosing the Right Foreign Currency Exchange Partner Matters

High fees and poor exchange rates can eat into your money transfer, leaving you with less than expected. This is especially important if you are making regular payments or transferring large sums, such as for property purchases or investments.

In Spain, the convenience of local currency exchange services near you offers added benefits, such as personalized advice and faster transactions. It is also necessary to present ID documents for currency exchanges to ensure compliance with anti-money laundering and anti-terrorist financing regulations. By choosing a trusted currency broker or money exchange near you, you can avoid unnecessary fees and maximize your foreign currency value.

Understanding Currency Exchange in Spain

Currency exchange is the process of converting one currency into another, a common practice for tourists, expats, and businesses engaged in international trade. In Spain, the primary currency is the euro, but you can exchange other currencies at various currency exchange offices or banks.

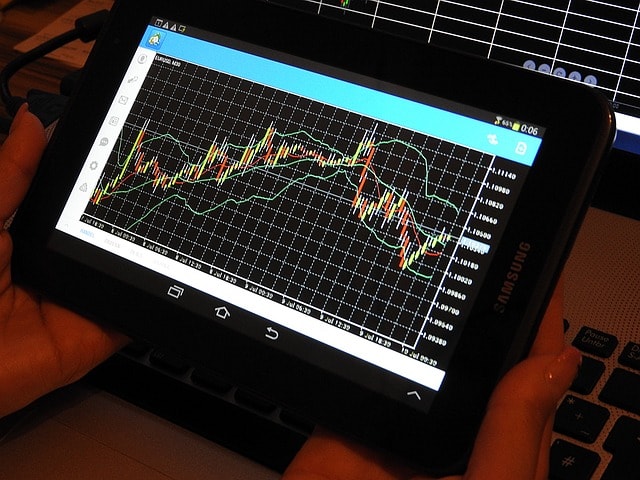

Foreign currency exchange rates, determine how much one currency is worth in terms of another, fluctuate constantly due to market forces and economic factors. For instance, if the exchange rate between the euro and the US dollar is 1 EUR = 1.20 USD, it means one euro can be exchanged for 1.20 US dollars. Understanding these foreign currency rates and their fluctuations is crucial for getting the best value when exchanging money.

What is Currency Exchange?

Currency exchange is the process of converting one currency into another, a fundamental aspect of international trade and finance. Whether you are a tourist, an expat or a business engaged in cross-border transactions, understanding currency exchange is crucial. The exchange rate, which is the price of one currency in terms of another, plays a pivotal role in this process. Exchange rates are determined by market forces and economic factors, such as interest rates, inflation, and political stability. For instance, if the exchange rate between the euro and the US dollar is 1 EUR = 1.20 USD, it means one euro can be exchanged for 1.20 US dollars. Keeping an eye on these rates can help you get the best value when exchanging money.

Top Tips to Find the Best Currency Exchange Near Me in Spain

Here is what you should look out for with a forex broker in Spain who fully understands your needs:

Search Online for the Best Forex Broker Local Options

Use targeted searches such as “money exchange near me” or “currency exchange Spain” to locate services in your area. This is particularly useful for expats and travelers looking for quick and reliable foreign exchange services.

Compare Foreign Exchange Rates and Fees

Don’t settle for the first option you find. Check foreign exchange rates online and compare the fees charged by various providers. Use tools or apps that specialize in currency comparisons to establish and fully understand who is the best forex broker.

Read Testimonials and Reviews

Look for reviews from other customers who have used the service. Search for terms like “best currency exchange near me” or “recommended forex brokers” to find reliable options.

Prioritize Exchange Rate Transparency

Choose the best forex brokers that clearly list their fees and foreign currency exchange rates. Avoid services with hidden charges that could reduce the value of your currency.

Consult a Currency Broker

For larger transactions or regular transfers, work with a forex broker. The best forex broker often provides tailored foreign currency strategies and better exchange rates compared to traditional banks and trading platforms.

Research and Choose the Best Forex Brokers

It’s crucial to research and choose the best forex broker in the financial markets for your specific needs. Look for brokers that are highly rated based on regulatory compliance, trading conditions and user experience. This will help you make informed choices tailored to your trading profile, whether you are a beginner, retail investor accounts or professional trading investor trading complex instruments.

Currency Exchange Offices in Spain

Currency exchange offices are conveniently located throughout Spain, especially in tourist hotspots and major cities. These offices handle a variety of currencies, including the Australian dollar, Canadian dollar, Hong Kong dollar, and Singapore dollar. These offices offer a variety of services, including foreign currency exchange, international transfers, and even travel insurance. Here are some of the most popular options:

Eurochange:

With over 40 locations across Spain it is one of the largest currency exchange office chains in the country. They offer competitive foreign currency rates and a range of services to meet your needs.

Western Union:

Known globally, Western Union has a significant presence in Spain. Their offices provide not only currency exchange but also international transfer services, making it a versatile choice.

Travelex:

Another global player, Travelex has several locations in Spain. They offer currency exchange services along with travel insurance, ensuring you are covered on all foreign currency fronts.

These offices are designed to make your currency exchange process smooth and efficient, whether you are dealing with euros, US dollars, or other foreign currencies.

However if you are a UK national looking to open a retail investor accounts then there are FCA regulated forex brokers in Spain which offer a more compelling proposition.

Key Features to Look for in Currency Exchange Services and Exchange Rates

Not all currency exchange providers are the same. To ensure you are getting the best deal, look for these features:

Low or Zero Transaction Fees

Providers offering low or no fees help you save significantly on your transfers.

Competitive Foreign Currency Exchange Rates

Always prioritize foreign currency services that provide competitive rates for the Euro against a basket of currencies mainly the Pound Sterling and US Dollars although it can extend to Australian dollar, Canadian dollar, Hong Kong dollar and Singapore dollar as well as other currency pairings. Even small differences can impact your overall amount, especially with large transactions.

FCA-Regulated Providers

Ensure your provider is regulated by financial authorities, such as the FCA in the UK, to guarantee funds are secure.

Value-Added Services

Look for features like forward contracts, which allow you to lock in favorable exchange rates for future transactions, or foreign currency rate alerts for real-time updates.

Trading Platforms

Selecting appropriate trading platforms based on individual trading styles and preferences is crucial. Different trading platforms offer various features, so choose one that aligns with your trading platform needs.

Benefits of Using a Forex Broker in Spain

A currency broker often provides distinct advantages over traditional banks or local money exchange centers or even trading platforms that can make you start losing money rapidly. Here’s why they are worth considering:

Lower Margins, Better Rates

Brokers operate with lower margins, allowing them to offer better foreign currency rates than banks.

Personalized Strategies

Brokers provide tailored foreign currency solutions, whether you are making regular transfers for living expenses or one-off payments for large purchases like property.

FCA Regulation

Reputable brokers are regulated, ensuring your funds are held securely in segregated accounts.

Tools to Mitigate Risks Involved

With features like forward buying and stop-loss orders, foreign currency brokers help protect you from currency market fluctuations.

However, it’s important to be aware of the risks associated with trading CFDs. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A significant percentage of retail investor accounts experience losses when trading complex instruments such as CFDs. Therefore, understanding these financial products and the associated risks is crucial before engaging in CFD trading.

For British expats retiring to or living in Spain, foreign currency brokers simplify complex transactions while maximizing your savings.

How to Verify CNMV Authorisation

The Comisión Nacional del Mercado de Valores (CNMV) is Spain’s financial regulatory body, ensuring the integrity of the financial markets and protecting investors. Verifying CNMV authorisation for foreign currency exchange offices and forex brokers is a crucial step to ensure your transactions are secure. Here’s how you can do it:

Check the CNMV Website:

The CNMV website lists all authorised financial institutions, including forex brokers and currency exchange offices. This is the most reliable source for verification.

Visit the Company’s Website:

Reputable companies will display their CNMV authorisation number on their website. Look for this information in the footer or the ‘About Us’ section.

Contact the CNMV:

If you are unsure, you can directly contact the CNMV to verify a company’s authorisation status. This extra step can provide peace of mind.

Remember, CNMV authorisation is essential for any financial institution operating in Spain, but it’s not the same as regulation. Always ensure that the institution is both authorised and regulated to safeguard your financial transactions.

FAQs About Currency Exchange Near Me in Spain

Here’s what you need to know to get the best currency exchange near you in Spain:

How can I find the best currency exchange rates in Spain?

To secure the best exchange rates, compare rates and fees from multiple providers, including banks, exchange centers, and specialized brokers. Opt for FCA-regulated brokers for secure transactions and competitive rates.

Why is it important to choose an FCA-regulated currency exchange provider?

FCA-regulated providers adhere to strict financial standards, ensuring secure, transparent and reliable transactions. This protects your money and gives you peace of mind during the exchange process.

What should I consider when comparing currency exchange providers?

Focus on:

Exchange rates: Ensure they are competitive.

Fees: Avoid providers with hidden charges.

Services: Look for added features like forward contracts or rate alerts to lock in favorable rates.

Are brokers better than banks or exchange centers for currency exchange?

Yes, forex brokers often offer better foreign exchange rates and lower fees than banks or exchange centers. They also provide tailored strategies, making them ideal for large transactions or regular payments.

How can I reduce risks in currency exchange for large transactions?

For significant transactions like property purchases or investments, work with an experienced forex broker. They can offer tools like forward contracts to secure favorable rates in advance, protecting you from market fluctuations.

What tools can help me maximize my currency exchange value?

Tools like rate tracking, forward contracts and limit orders allow you to monitor rates, lock in preferred rates and automate transactions, ensuring you get the most value for your money.

Why is planning ahead essential for currency exchange?

Planning helps you avoid unnecessary fees and ensures you can take advantage of the best rates. Brokers can provide personalized foreign currency strategies for recurring payments or large one-time transactions, saving you money in the long run.

By following these guidelines and working with trusted professionals, you can maximize the value of your currency exchange in Spain and achieve your financial goals.

Best Practices for Large and Small Transactions

For Large Transactions (e.g., Buying Property)

Timing Matters: Work with a forex broker to time your transfer for the best foreign exchange rate.

Customized Strategy: Brokers analyze market trends and suggest the best approach for your specific needs.

For Small Regular Transfers

Ease of Use: Look for trading platforms offering automated transfers.

Rate Stability: Lock in exchange rates with forward contracts to avoid market volatility.

Conclusions and Call To Action

Finding the best currency exchange near you in Spain doesn’t have to be complicated. By prioritizing low fees, high exchange rates, and reliable brokers, you can make the most of your international transactions. Whether you are moving to Spain, retiring there, or simply visiting, the right currency exchange service will help you save money and ensure stress-free financial dealings.

If you are looking for expert advice and tailored solutions for your foreign exchange needs, contact us today for a free consultation. Our team specializes in helping British expats and individuals maximize their funds with personalized currency exchange strategies.

Contact Us Today

If you are a UK national in Spain, a good forex broker saves you time, money and stress.

Contact us today to start saving on your currency transfers now!

Telephone: +350 5600 5757

Email: [email protected]

Useful Resources

For further information please visit the website page: https://adviceforexpats.com/why-uk-nationals-use-top-forex-brokers-in-spain/

Useful link: https://www.forexcrunch.com/blog/forex-weekly-outlook/

Useful link: https://www.fxempire.com/news