QROPS in Australia

Managing your pension as a UK expat requires a strategic approach to maximize benefits, reduce tax liabilities and secure long-term financial stability. Many UK nationals moving abroad fail to optimize their pensions, leading to unnecessary tax burdens and missed investment opportunities. Without a proper expat pension plan, individuals risk losing access to tax-efficient retirement schemes, facing currency fluctuations and paying more in overseas pension taxation.

Understanding how much to save for retirement is a key consideration for UK expats. The right pension plan should align with your financial goals, offer flexibility in withdrawals and ensure compliance with local pension laws in your chosen new country of residence.

To make informed decisions about your retirement planning, consider our pension advisory service, which helps you navigate the complex world of international pension schemes. Our pension advisors specialize in offering tailored advice for tax-efficient pension transfers and strategic financial planning, ensuring your retirement savings are optimized for both local and international regulations. With expert guidance from our pension advisory service, you can confidently plan for a secure retirement abroad. A financial advisor for pensions can help you navigate the complexities of pension transfers, ensuring you make tax-efficient decisions that maximize your retirement savings.

Different countries impose varying tax rates on pension withdrawals and not all UK pension schemes are tax-efficient for expats. Many retirees choose to establish pensions in Malta, pensions in Gibraltar or pensions in Portugal because these jurisdictions offer favourable tax treatment under Double Taxation Agreements (DTAs). Understanding how DTAs work can help you avoid paying UK tax on overseas pensions and reduce pension transfer costs.

To understand how tax can impact your pension abroad, please visit ‘Tax Planning for UK Expats’ for expert advice.

To learn more about ‘The UK’s Statutory Residence Test ’ please visit the HMRC page.

Moreover, UK expats need to protect their pension assets from inflation, currency fluctuations and regulatory risks. This is where international pension schemes such as:

International Pension Plans come into play, providing flexible, tax-efficient retirement solutions tailored for expatriates.

Take Control of Your Expat Pension. Maximise tax efficiency and secure your retirement with expert pensions advice tailored to UK expats. Our pension advisors are here to help you take control of your financial future and guide you through the most effective options.

Call us today on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com or Request a Private Consultation!

While International SIPPs are an ideal solution for many UK expats, International Pension Plans provide another flexible, tax-efficient solution for individuals who require a global retirement option that works across multiple countries and financial systems.

One of the biggest advantages of an International SIPP is that it enables tax-efficient retirement planning, allowing UK expats to diversify their pension investments, access global markets and choose a multi-currency structure. This makes SIPP pensions an excellent option for UK nationals living in Europe, the Middle East, Asia or beyond.

For further assistance with managing your pension and other financial services while living abroad, explore our ‘Financial Services for UK Expats’ page for expert advice.

An International SIPP offers greater investment flexibility and potential tax advantages compared to traditional UK pension schemes. While still regulated by the UK Financial Conduct Authority (FCA) and subject to UK pension rules, it provides expats with a tax-efficient and globally portable retirement solution. Speak with our pension advisors to ensure you are making the most tax-efficient retirement decisions, helping you maximize your pension growth and minimize tax liabilities.

Many UK expats accumulate multiple pension schemes from different employers, creating administrative complexity and making it challenging to manage their retirement savings efficiently. An International SIPP simplifies this process by allowing expats to consolidate multiple pensions into a single, easily managed fund, reducing paperwork and optimizing investment strategy.

Most private and company pensions can be transferred into an International SIPP, making it a practical alternative to QROPS while providing easier pension tracking and management for expats living abroad.

Additionally, consolidating pensions into an International SIPP not only simplifies pension management but may also reduce administrative costs, as multiple pension schemes often incur separate fees. By streamlining pensions into a single, cost-effective plan, expats can minimize unnecessary charges while ensuring greater control over their retirement funds.

If you are considering consolidating multiple pensions, our pension advisors can provide the guidance you need to choose the best solution for your unique financial goals.

One of the key advantages of an International SIPP is that assets grow tax-free until withdrawals are made, allowing pension savings to compound efficiently over time. Taxes only apply upon withdrawal, and the tax treatment depends on your country of tax residency. If a Double Taxation Agreement (DTA) is in place, it may provide reduced tax rates or exemptions, making pension withdrawals more tax-efficient for UK expats.

To better plan your retirement withdrawals, use this ‘Pension Drawdown Calculator’ to calculate how much income you can safely withdraw from your pension each year.

For UK expats living abroad, currency fluctuations can significantly impact retirement income, making multi-currency flexibility a crucial feature of an International SIPP. This type of pension allows expats to hold and invest in multiple currencies, including GBP, EUR, USD and other major global currencies, reducing exchange rate risks and ensuring that pension withdrawals align with their country of residence.

By keeping pension assets in a currency that matches future expenses, expats can protect their retirement savings from currency volatility and have greater control over their withdrawal strategy to meet financial needs. Expats can also withdraw funds in their preferred currency, minimizing conversion costs and ensuring financial stability in retirement.

Unlike standard UK workplace pensions, an International SIPP provides UK expats with access to a diverse selection of funds in multiple currencies, offering greater flexibility compared to domestic SIPPs, which are primarily GBP-denominated and UK-focused. Unlike domestic SIPPs, which are designed for UK residents, International SIPPs provide access to funds tailored for non-UK residents, offering more relevant investment opportunities that align with global markets and expat financial needs.

An International SIPP remains under the regulation of the UK Financial Conduct Authority (FCA), ensuring a high level of security and investor protection that offshore pension schemes, such as QROPS, may not offer. FCA oversight guarantees strict compliance with UK pension regulations, providing greater transparency and accountability compared to some offshore pension plans. This makes an International SIPP an ideal option for UK expats who wish to maintain a UK-based pension arrangement while benefiting from robust financial safeguards. For expats who require a UK-compliant pension structure, an International SIPP ensures regulatory protection while providing the flexibility of international investment options.

An International SIPP offers flexible withdrawal options, allowing UK expats to align their pension income with other retirement earnings for better financial planning. Lump sums or phased withdrawals can be accessed based on individual needs, with the option to delay withdrawals in high-tax years to reduce tax exposure.

Coordinating withdrawals with other income streams ensures tax efficiency and helps optimize retirement cash flow. This level of income planning flexibility enables UK expats to structure their finances strategically, ensuring their retirement savings are managed effectively.

For UK expats who may eventually return to the UK, an International SIPP provides greater flexibility compared to QROPS. If an expat moves back to the UK, their pension remains within UK jurisdiction without requiring complex transfers, simplifying the transition and ensuring continued access to retirement funds.

Unlike some offshore pension schemes, an International SIPP remains fully compliant within the UK, ensuring a smooth transition if you decide to return home. Additionally, an International SIPP imposes no restrictions on relocating between countries, making it a suitable option for those living in Europe, the Middle East Asia, or beyond.

Important Note: While an International SIPP offers many advantages, it is still subject to UK pension rules and withdrawals are taxable under UK law unless tax residency in another jurisdiction provides exemptions via a Double Taxation Agreement (DTA).

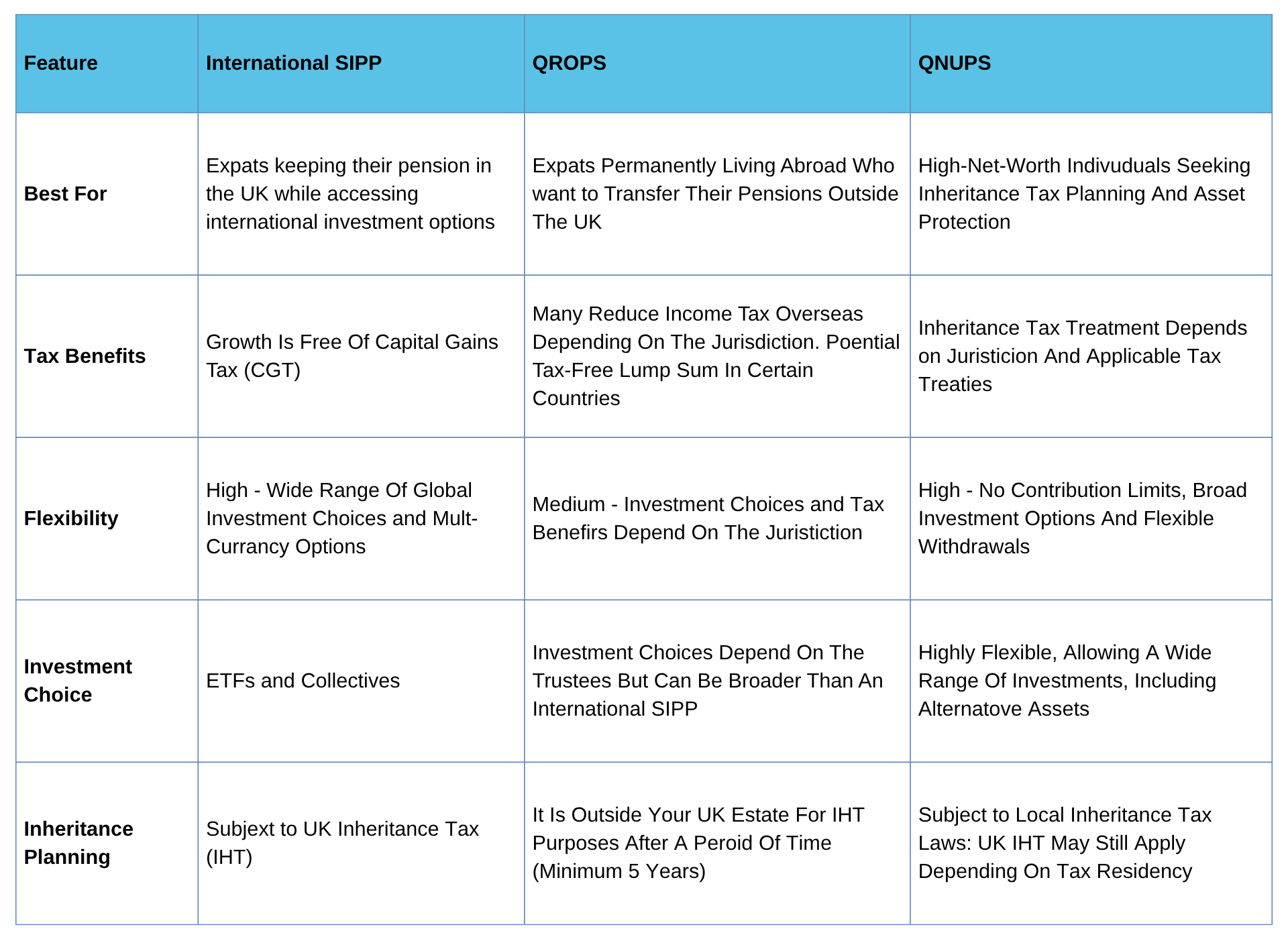

Choosing the best pension option is essential. Our pension advisors can help you determine whether an International SIPP, QROPS or QNUPS is best for your retirement needs.

In addition to QROPS, QNUPS, and International SIPPs, International Pension Plans offer an attractive alternative for expats seeking global retirement solutions. They allow for better flexibility across various jurisdictions, especially for those moving between countries.

If you are keeping your pension in the UK, an International SIPP is often the best choice.

If you are permanently moving overseas, QROPS might provide greater tax advantages, however the Overseas Transfer Allowance (OTA) formerly referred to as the Lifetime Allowance Charge (LTC), and the Overseas Transfer Charge (OTC) make render a transfer uneconomic.

While most expats opt for defined contribution pensions, some may still qualify for a defined benefit pension based on their previous UK employment. A defined benefit pension can offer guaranteed income in retirement, which may be appealing for those looking for financial security in their later years.

Calculate your ‘Pension’s Transfer Value quickly and easily with a CETV Calculator.’ This tool helps you determine whether transferring your defined benefit pension could be beneficial based on current market values.

For inheritance tax planning, QNUPS used to be the best option but following the UK Autumn Budget it offers no protection for UK Inheritance Tax purposes. An international pension plan is a better choice.

Want expert guidance? Our panel of experienced pension specialists can help you navigate the complexities of International SIPPs, QROPS, QNUPS or international pension plans such as Guernsey’s Section (40) ee pension schemes; ensuring you choose the most tax-efficient and flexible pension option based on your financial goals and country of residence.

Call us today on Tel: +350 5600 5757 for a personalized consultation.

Email us at connect@adviceforexpats.com to discuss your pension options.

Book a Free Pension Consultation

A Qualifying Recognised Overseas Pension Scheme (QROPS) is an HMRC-recognized pension that allows UK expats to transfer their UK pension to an overseas scheme. QROPS are designed to provide greater tax efficiency, investment flexibility and estate planning benefits for those permanently living outside the UK.

UK expats often consider transferring to a QROPS to reduce tax liabilities, protect pension assets from UK legislation changes and secure inheritance tax planning advantages. However, QROPS are not suitable for everyone, and suitability depends on country of tax residency and retirement goals.

Speak with our expert pension advisors to determine whether a QROPS transfer aligns with your retirement strategy and tax planning needs.

For detailed information on transferring your UK pension, refer to ‘The Pensions Regulator’s Dealing with Transfer Requests’ page.

A Defined Benefit (DB) pension is a retirement plan where the amount you receive in retirement is determined by factors such as your salary and years of service. This type of pension offers guaranteed income, making it an attractive option for many employees.

DB pensions provide security, as they promise a set income in retirement. However, they are becoming increasingly rare, with many employers switching to defined contribution (DC) schemes. Pension advisors, supported by a qualified pensions actuary, can help you understand how it works and whether it aligns with your retirement objectives.

A QROPS allows pension assets to grow free from local capital gains tax (CGT) while inside the pension scheme. However, tax on withdrawals varies depending on the expat’s country of residence and the specific tax rules in place. Some jurisdictions offer lower or zero tax rates (in Dubai), while others may apply standard income tax rates to pension withdrawals. Additionally, UK tax rules may still apply if the individual remains UK tax resident or returns to the UK within a specific timeframe. Proper tax planning and pension advice are essential to optimize withdrawals under local tax laws and Double Taxation Agreements (DTAs) where applicable.

For detailed guidance on the rules governing pension transfers and withdrawals, please visit ‘The Financial Conduct Authority’s COBS 19.1 Pension Transfers’ page.

QROPS allow expats to hold pension funds in multiple currencies reducing foreign exchange risks and aligning pension withdrawals with their country of residence.

After five years of non-UK residency, a QROPS is typically outside of the UK estate for UK inheritance tax purposes, potentially offering significant wealth preservation benefits.

A QROPS is only a viable option when both the pension scheme and the individual member reside in the same country. If a UK national moves to Malta, Gibraltar, Ireland, New Zealand or Australia and transfers their pension into an HMRC listed ROPS scheme in that country, they are not subject to the UK Overseas Transfer Charge (OTC). Each jurisdiction has different tax rates on pension income and regulatory frameworks, which should be carefully considered when deciding where to transfer a UK pension.

QROPS in Australia

QROPS in New Zealand

QROPS in Ireland

QROPS in Malta

QROPS in Gibraltar

QROPS jurisdictions vary in tax treatment and regulations, making it essential to choose a location that aligns with your retirement and tax planning needs.

Transferring your UK pension to a QROPS requires careful planning to ensure tax efficiency and compliance with both UK and local tax regulations.

Be aware that delays in UK pension transfers can occur, especially if paperwork is incomplete or compliance checks by UK pension providers take longer than expected due to the requirements of the Pension Schemes Act 2021.

Our specialists proactively handle the entire transfer process to reduce these delays, ensuring your pension funds are transferred smoothly and efficiently.

Be aware of potential pension transfer delays when moving your UK pension abroad. These delays can impact your retirement timeline, so it’s important to plan ahead and ensure the paperwork and transfers are managed efficiently.

If QROPS isn’t the right choice for you, an International Pension Plan could offer a more suitable global retirement solution, particularly for individuals seeking broader options than traditional pension schemes. These plans are especially beneficial for those who need flexibility across various countries.

To learn more about UK Pension Transfers to QROPS we recommend visiting ‘The MoneyHelper’s’ page to ensure you understand all the potential costs and benefits.

Call Tel: +350 5600 5757 or email connect@adviceforexpats.com to discuss your pension options.

A Qualifying Non-UK Pension Scheme (QNUPS) is a flexible retirement and investment vehicle designed for expats and high-net-worth individuals looking for long-term wealth accumulation and financial planning. QNUPS offer a unique opportunity for UK nationals to maximize their retirement savings, particularly for those seeking tax-efficient structures.

Unlike QROPS, QNUPS have no UK pension contribution limits, making them attractive for individuals who have maximized their UK pension allowances and need a tax-efficient structure for further savings.

Historically, QNUPS were marketed as a tool for mitigating UK Inheritance Tax (IHT), but following the UK Autumn Budget 2024, they are now classified as UK pensions for IHT purposes.

This means QNUPS remain subject to UK IHT, regardless of where the scheme member resides. While the full impact on UK non-residents remains unclear, QNUPS no longer provide the IHT exemption they once did.

Despite this change, QNUPS continue to offer several benefits, including unrestricted investment flexibility, multi-currency options and no lifetime contribution limits.

QNUPS remain a powerful tool for those looking to secure long-term wealth, with the added benefit of global portability and flexibility.

For more on protecting your wealth across borders, visit ‘Estate Planning for UK Nationals’ to learn how to secure your assets.

Call Tel: +350 5600 5757 or email connect@adviceforexpats.com to discuss your pension options.

Unlike UK pension schemes, QNUPS have no limits on contributions or investment options, making them a versatile tool for wealth management.

QNUPS are not restricted by UK pension contribution caps, allowing high-net-worth individuals to accumulate pension wealth efficiently.

Expats can invest in a wide range of asset classes and hold their pension in multiple currencies to mitigate foreign exchange risks.

While no longer an automatic UK IHT shield, QNUPS may still provide estate planning advantages, depending on jurisdictional tax laws.

International Pension Plans (IPPs) are globally portable pension schemes designed for expats, internationally mobile professionals and high-net-worth individuals who require a tax-efficient and flexible retirement solution. These plans provide flexibility across multiple countries and are an excellent alternative for individuals seeking broad, international options for their retirement savings.

Unlike QROPS or International SIPPs, which cater to UK pension transfers, IPPs are not restricted by UK pension rules and offer greater investment freedom.

Explore Your International Pension Options. Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com to discuss your retirement strategy.

The tax treatment of overseas pensions depends on the country in which you have established fiscal residency.

The Overseas Transfer Charge (OTC) is a 25% tax applied to UK pension transfers to a QROPS, if the scheme, is located in a country, where the individual is not a tax resident at the time of transfer.

However, transfers to HMRC-approved ROPS schemes in Malta, Gibraltar, Ireland, New Zealand, Australia and other qualifying jurisdictions are exempt from the OTC if the individual is a tax resident in the same country as the QROPS pension trustees.

Reduce Your Expat Pension Tax Liability! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com for personalized pension planning advice.

Planning how your pension is passed on is essential for UK expats. The tax treatment of pensions upon death depends on the type of pension scheme, your residency and the age at which you pass away. Understanding these factors ensures your beneficiaries receive the maximum possible benefit.

In addition to private pensions, it’s crucial to include a pension forecast for your UK state pension to better understand the total retirement income you can expect, especially if you are receiving a UK state pension while living abroad.

Secure Your Pension for Future Generations! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com for expert estate planning advice.

Understanding retirement as a UK expat requires a clear assessment of living costs, pension income needs, and potential tax liabilities. The amount required depends on factors such as your chosen country of residence, lifestyle expectations, and access to healthcare.

The amount needed for a comfortable retirement abroad varies based on lifestyle, location, and personal financial goals. Some countries offer a lower cost of living, while others require a larger pension fund to maintain financial security. Below are some general guidelines for expats in estimating their retirement savings.

Some destinations offer significantly lower living costs than the UK, while others require a larger pension fund.

Get a Personalized Retirement Savings Plan. Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com for a free consultation.

Pension scams targeting UK expats have become increasingly sophisticated, with fraudsters exploiting gaps in regulation, offshore investment schemes and misinformation about pension transfers. Expats seeking tax efficiency and higher returns on their retirement funds can often become prime targets for unscrupulous operators. Losing your pension to a scam can have devastating financial consequences, making it crucial to stay informed and vigilant.

Fraudulent pension schemes can wipe out your retirement savings, making it crucial to take proactive steps to safeguard your funds. Staying informed and working with regulated professionals can help you avoid costly mistakes.

Don’t risk your retirement—speak to a trusted pensions expert today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com to secure your pension.

Navigating pension transfers, tax liabilities and international regulations as a UK expat can be complex. Without the right advice, you could face unexpected tax bills, compliance issues or financial losses. Seeking expert guidance ensures your pension is tax-efficient, secure and aligned with your long-term retirement goals.

Avoid Unnecessary Tax Liabilities: Transferring or withdrawing your pension incorrectly can trigger hefty tax charges. A regulated pension adviser can provide tax-efficient solutions.

Ensure Your Pension is Secure & Compliant: Some offshore pension schemes lack proper regulation. An FCA-regulated adviser helps you avoid scams and high-risk investments.

Get a Personalized Retirement Plan: Every expat has unique financial needs. The right pension structure depends on your country of residence, tax status and long-term retirement goals.

Don’t leave your pension to chance—get expert advice today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com to secure your financial future.

The best pension depends on your goals. QROPS, International SIPPs, QNUPS and International Pension Plans offer different benefits in terms of tax efficiency, inheritance planning and investment flexibility. An FCA-regulated pension adviser can help determine the most suitable option based on your residency and financial objectives.

It depends on the country. Some jurisdictions, such as Portugal, Malta, Gibraltar, and the UAE, offer low or tax-free pension withdrawals under Double Taxation Agreements (DTAs). Understanding your residency status and tax obligations is essential before transferring a pension.

QROPS is ideal for expats who have permanently left the UK, offering potential tax advantages and inheritance tax planning benefits. International SIPPs provide investment flexibility and lower costs but remain under UK jurisdiction. The best choice depends on your country of residency, tax status and long-term goals.

Retirement savings vary based on location and lifestyle. In general:

An expat retirement planner can help create a personalized savings strategy.

Always work with FCA-regulated advisers, verify any pension provider and avoid cold calls or unsolicited pension transfer offers. High-pressure sales tactics and “guaranteed” high returns are major red flags.

Get expert pension advice today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com to secure your financial future.

Yes, UK pensions can be accessed while living abroad. However, tax treatment depends on your residency status and whether a double taxation agreement (DTA) applies to avoid UK tax on withdrawals.

Your UK pension remains accessible, but currency fluctuations, tax implications and investment options should be considered. International SIPPs or QROPS may offer a more suitable structure for expats.

This depends on your long-term plans, tax residency and financial goals. Keeping a pension in the UK via an International SIPP ensures UK regulation and investment flexibility, while transferring to a QROPS can provide tax advantages in some jurisdictions.

State pension payments are taxable and depend on the tax treaty between the UK and your country of residence. Some jurisdictions exempt UK state pension income from local tax, while others apply standard income tax rates.

Need personalized pension advice? Speak to an expert now! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com for a private consultation.

At Advice for Expats, we offer expert international pension advice and retirement planning tailored to the unique needs of British expatriates. Whether you are considering an International SIPP, QROPS or QNUPS, our specialist advisers help you navigate the complexities of pension transfers, consolidation and tax-efficient retirement planning.

Our FCA-regulated network of pension specialists delivers clear, tailored strategies to ensure your retirement savings are optimised and protected—wherever you live.

We help British expats maximise pension benefits, avoid costly mistakes and choose the right pension structure for their residency, goals, and lifestyle. Trust us to align your pension plans with your aspirations, so your retirement is as rewarding as the life you have built across borders.

A secure and comfortable retirement overseas starts with the right pension advice. Let us connect you with the expertise you need to navigate the complexities of pensions, tax planning and international investment options as a British expat.

Whether you are transferring your UK pension abroad, exploring QROPS in Malta or Gibraltar, or consolidating multiple pensions into an International SIPP, we provide the guidance you need.

With confidence in your pension strategy, you can focus on enjoying the expat lifestyle you have worked hard to create.

Take the first step toward securing your financial future with confidence — expert pension advice today can help you retire smarter tomorrow.

Arrange your free initial consultation with a trusted UK pension expert today:

Telephone: +350 5600 5757

Email: connect@adviceforexpats.com