Introduction

Looking for the best conversion FX in Spain?

If you are a British expat in Spain or considering a move, managing international payments effectively is crucial. Whether you are buying property, sending money to family or paying for healthcare, choosing the right foreign exchange provider can save you time, stress and significant costs. Financial markets play a vital role in currency exchange by facilitating the buying and selling of various assets, including currencies. In this guide, we will explore the differences between currency brokers and banks, focusing on their services, fees and exchange rate options, to help you make the smartest choice for your needs.

Article Summary

For British expats living in or moving to Spain, effectively managing currency exchange is not just important—it’s essential for protecting your finances and ensuring long-term stability. Whether you are sending money for daily expenses, purchasing property, or transferring funds for larger investments, choosing the right provider can make a significant difference.

While banks may seem like a convenient choice, they often fall short when it comes to offering competitive exchange rates and flexible solutions. Their higher margins, transaction fees, and lack of specialized tools can cost expats thousands of pounds, especially for large or recurring transfers.

On the other hand, currency brokers, or conversion FX brokers, are designed to meet the unique needs of expats. With their lower margins, fee-free transfers, and access to advanced tools like forward contracts and limit orders, brokers provide tailored solutions to help expats manage their money efficiently. Additionally, brokers offer personalized support from dedicated forex specialists, helping expats navigate market volatility and secure the best possible rates. Forex broker offers include various financial services and trading platforms, making it crucial to select a reputable broker based on account features, support availability and the types of trading accounts available.

For British expats in Spain, working with a trusted currency broker is a smarter and more cost-effective way to manage international payments and maximize financial value. By choosing a broker over a bank, expats can save on fees, reduce risks, and take greater control of their finances.

Currency brokers offer a winning combination of competitive rates, tailored services and expert advice, making them the best option for British expats managing their money in Spain.

Key Takeaways: Choosing the Best Option for Your Currency Exchange Needs

When managing international money transfers, especially as a British expat in Spain, understanding the key differences between banks and currency brokers is crucial. Choosing the best forex brokers for your currency exchange needs can significantly impact your financial outcomes. Whether you are sending money for property purchases, living expenses or ongoing commitments, these points summarize why currency brokers often emerge as the better choice.

-

Banks vs Brokers: Brokers charge significantly lower margins (0.50-1.00%) compared to banks (2-4%), which can result in substantial savings, especially on larger transfers. However, for smaller amounts (e.g. under £5,000), the margin might creep higher, potentially reaching 5% in some cases. A 6% margin would generally be at the extreme upper end of the scale and is more likely to apply to niche or infrequent transfers or when additional factors (like exotic currencies) are involved.

-

Advanced Tools: Brokers provide access to specialized tools such as forward contracts, limit orders and risk management services, ensuring your funds are protected from market volatility.

-

Savings Potential: By choosing a broker, you can save up to £6,000 on a £200,000 transfer compared to using a bank, making them the more cost-effective option. Forex brokers specialize in forex transactions and operate on tighter profit margins.

-

Tailored for Expats: Brokers offer personalized solutions for British expats in Spain, including regular overseas payment automation and real-time exchange rate insights.

-

Transparency and Support: Currency brokers are known for their transparent fee structures, with many offering fee-free transfers and access to a dedicated account manager for guidance.

-

Flexibility: Brokers cater to diverse needs, whether it’s one-off large transactions or smaller, regular payments such as pensions or rental income.

-

Speed of Transfers: Many brokers can process transfers faster than banks, ensuring that funds reach their destination without unnecessary delays.

-

Market Expertise: Brokers employ forex specialists who can help you monitor exchange rate trends and capitalize on favorable market conditions.

The Importance of Selecting the Best Forex Broker as Your Currency Exchange Partner

For British expats in Spain, transferring money across borders is often a regular necessity. From purchasing euros for daily expenses to investing in Spanish property, the value you receive depends on several key factors:

Selecting the best forex broker involves evaluating criteria such as regulation, fees, and trading features to ensure you find the most suitable broker for your specific trading needs.

Exchange rates: Even small variations in rates can have a significant financial impact.

Fees: Hidden fees or high transaction costs can erode the value of your transfer.

Security: Ensuring your funds are handled securely is essential.

Choosing between banks and currency brokers can seem straightforward, but understanding the key differences will help you maximize your savings.

What is a Forex Broker?

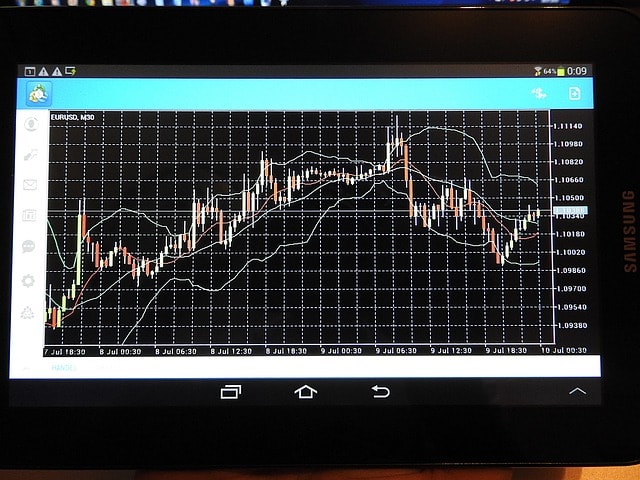

A forex broker is a financial intermediary that offers access to a trading platform for buying and selling currencies. These brokers execute financial transactions on behalf of traders, providing a platform for trading currency pairs, such as GBP/USD (Pound – US dollar). Essentially, forex brokers act as the bridge between retail forex traders and the forex market, facilitating the buying and selling of currencies.

Choosing the right forex broker is crucial for successful trading. Look for brokers that are regulated by reputable financial authorities, offer competitive spreads and provide a user-friendly trading platform. Additionally, consider the range of currency pairs available, the quality of customer support, and the educational resources offered to help you navigate the forex market effectively.

Why Banks Fall Short in Currency Exchange Services

While banks are a familiar choice for many, they often lack the specialized services that expats require for managing currency exchange efficiently.

Limited Expertise: Most banks don’t employ dedicated forex specialists, leaving customers without personalized advice.

Basic Options: Banks typically don’t offer advanced tools like forward contracts or limit orders.

Higher Margins: Banks often charge a 3-4% exchange rate margin, significantly higher than most forex brokers.

For instance, if you’re converting £10,000 to euros, a bank margin of 4% means you lose £400 in hidden costs.

Forex Brokers: A Specialist Alternative for Expats

Currency brokers provide tailored solutions for expats in Spain, offering cost-effective and efficient services.

Dedicated Forex Specialists: Brokers offer personalized support to navigate the complexities of the foreign exchange market.

Competitive Margins: Brokers typically charge a margin of 0.5-1%, which can save you thousands compared to banks.

Advanced Tools: Services such as forward contracts, limit orders and automated regular overseas payments make brokers the preferred choice for expats.

Cost Comparison: Banks vs Forex Brokers

Here’s a comparison of the average exchange rate margins and fees:

Provider

Exchange Rate Margin

Transaction Fees

Additional Features

Banks

3-4%

£15-£40 per transfer

Basic online transfer services

Currency Brokers

0.5-1%

Fee-free

Risk management tools, personalized advice

Key Insight: A currency broker can save you up to £3,000 on a £100,000 transfer when compared to a bank.

Breadth of Conversion FX Services

Managing currency exchange effectively requires the right tools and services, especially for British expats in Spain. While banks may seem convenient, their limited options often fall short of meeting expat needs. Currency brokers, however, excel in providing tailored solutions, advanced tools, and cost-effective services that simplify and enhance foreign currency transfers.

Banks

While convenient, banks typically offer limited forex options. Their services are geared toward one-off transfers, and they rarely cater to the specific needs of expats in Spain.

Currency Brokers

Brokers provide a comprehensive suite of services tailored to expats:

Forward Contracts: Lock in a favorable rate for up to two years, ideal for budgeting expenses like property purchases.

Regular Overseas Payments: Automate recurring transfers, such as pensions or rental income, with ease.

Limit Orders: Target a specific rate and execute transfers automatically when the market hits your goal.

Forex Trading in Spain

Forex trading is a popular form of investment in Spain, with many online forex brokers offering their services to Spanish residents. However, it’s important to note that forex brokers are not required to be authorized by the Comisión Nacional del Mercado de Valores (CNMV) to accept residents of Spain as customers. Despite this, choosing a reputable and regulated forex broker is essential to ensure a safe and secure trading environment.

When selecting a forex broker in Spain, consider factors such as regulatory status, trading platform features and customer support. Reputable brokers are typically regulated by well-known financial authorities, such as the Financial Conduct Authority (FCA) in the UK or the European Securities and Markets Authority (ESMA). These regulations help protect traders by ensuring brokers adhere to strict standards of conduct and financial stability.

Exchange Rate Volatility and Risk Management

The forex market is volatile, with rates fluctuating daily. For British expats relying on regular transfers, this can lead to unexpected losses. Currency brokers offer tools like:

Stop-Loss Orders: Protect against unfavorable market movements by setting a minimum acceptable rate.

Rate Alerts: Stay informed about market trends with real-time updates.

These options ensure that expats can safeguard their wealth against sudden market changes.

Case Study: A British Expat Buying Property in Spain

Scenario: John, a British expat, needs to transfer £200,000 to purchase a villa in Spain.

Banks:

With a 4% margin, John would pay £8,000 in hidden fees.

Forex Brokers:

With a 1% margin, John pays just £2,000, Saving £6,000.

This example highlights the substantial savings available when choosing forex brokers over banks.

Security and Transparency of Forex Brokers

Both banks and brokers adhere to strict regulatory standards, ensuring that your money is safe. However, brokers often provide:

Greater Transparency: Real-time rate updates and no hidden fees.

Flexible Services: Tailored solutions for expats with diverse needs.

While both banks and brokers ensure regulatory compliance and the safety of your funds, currency brokers stand out for their transparency and flexibility. Their real-time updates, clear fee structures, and tailored services make them a reliable and practical choice for British expats in Spain looking to manage their international payments effectively.

How to Choose the Right Conversion FX Provider

When deciding between a bank and a broker, consider:

Transaction Size: Larger transfers benefit more from the competitive rates offered by brokers.

Frequency: If you are transferring money regularly, forex brokers’ automated tools can save time and reduce costs.

Support: Look for a provider with a dedicated account manager and real-time rate insights.

For British expats in Spain, forex brokers offer better rates, automated tools, and personalized support, making them the smarter choice for managing international transfers efficiently.

FAQs About Forex Brokers in Spain

For British expats in Spain, understanding the ins and outs of working with forex brokers can help you make informed decisions about managing your international payments. Below are answers to some of the most common questions expats have about currency exchange services.

What is the main advantage of using a forex broker over a bank?

Forex brokers typically offer lower exchange rate margins (0.5-1%) compared to banks (3-4%), along with fee-free transfers and advanced tools like forward contracts and limit orders. This makes them a cost-effective option for expats managing large or frequent international transfers.

Are forex brokers regulated in Spain?

Yes, most forex brokers operating in Spain are regulated by financial authorities such as the Bank of Spain, Financial Conduct Authority (FCA) in the UK,or European Securities and Markets Authority (ESMA). Always choose a broker with strong regulatory credentials to ensure the security of your funds.

Can I use a forex broker to automate regular transfers?

Yes, many forex brokers offer tools for regular overseas payments, allowing you to automate recurring transfers such as pensions, mortgage payments, or rental income. This simplifies the process and ensures you get competitive rates for every transaction.

How much can I save by using a forex broker?

Savings depend on the size of your transfer. For example, on a £50,000 transfer, a forex broker could save you up to £1,500 compared to a bank, thanks to better rates and no fees.

What types of currencies can I exchange through a forex broker?

Forex brokers handle a wide range of currencies, including major currencies like pounds, euros and dollars, as well as more exotic currencies. This flexibility is ideal for expats with diverse currency needs.

How do I open an account with a forex broker?

Opening an account is simple and typically free. You’ll need to provide identification (such as a passport), proof of address, and details of your currency transfer needs. Once registered, you can start transferring funds immediately.

Are there any hidden fees when using a forex broker?

Reputable brokers are transparent about fees and often operate on a fee-free basis, relying on a small exchange rate margin instead. Be sure to confirm all charges upfront to avoid surprises.

Choosing the right forex broker can significantly impact your financial planning as a British expat in Spain. With the right provider, you can save money, reduce risks, and gain access to expert advice and tailored services for your unique needs.

Conclusion: Take Control of Your Finances Today

Choosing a currency broker over a bank is a smart decision for British expats in Spain. With better rates, fewer fees, and advanced tools, brokers help you maximize your wealth while minimizing risks.

Ready to save on your international transfers?

Request a free consultation today to discover how a trusted forex broker can make your money go further.

If you are a British expat in Spain or considering a move, managing international payments effectively is crucial. Whether you are buying property, sending money to family or paying for healthcare, choosing the right foreign exchange provider can save you time, stress and significant costs.

Contact Us: Maximize Your Currency Savings Today

Stop losing money to high fees and poor rates. Our trusted forex broker partners offer competitive rates, expert advice and tailored solutions for British expats in Spain.

Get Conversion FX Support With FCA Regulated Forex Brokers in Spain

Get a free consultation with a forex broker.

Maximize your savings with bespoke currency broker strategies.

Access advanced tools like forward contracts and automated transfers.

Contact us today for your free consultation:

📞 Call: +350 5600 5757

📧 Email: connect@adviceforexpats.com

Useful Resources

Useful Resources:

Living in Spain – GOV.UK

This comprehensive guide provides essential information for British citizens moving to or residing in Spain, covering topics such as visas, residency, healthcare, and more.

https://www.gov.uk/guidance/living-in-spain

Financial Conduct Authority (FCA)

The official website of the UK’s financial regulatory body offers insights into financial services regulation, including information on forex brokers and consumer protection.

UK Help and Services in Spain – GOV.UK

This resource provides information on services available to UK nationals in Spain, including guidance on living, studying, working, or doing business in Spain.

https://www.gov.uk/world/spain