- 1 Moving to Portugal from UK: Visas, Residency & Living Guide

- 2 How Easy is it to Move to Portugal from UK?

- 3 Challenges of Living to Portugal for UK Expats

- 4 How do I move to Portugal from UK?

- 5 Moving to Portugal: Understanding Residency Options

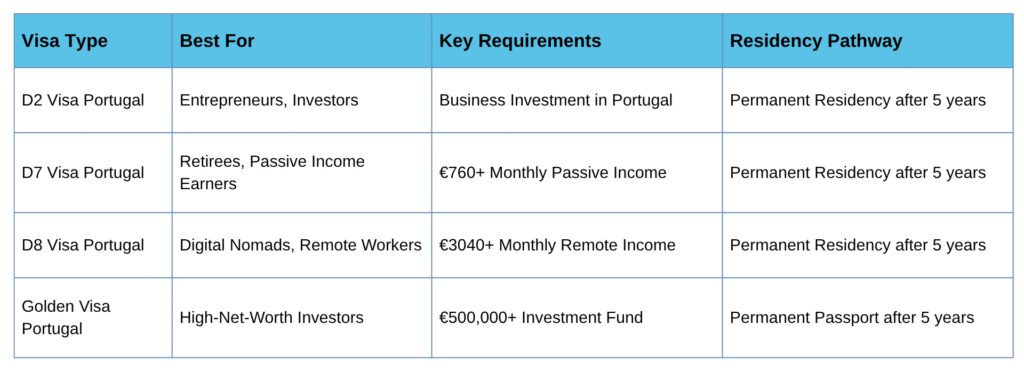

- 6 Summary: Visas for Portugal Options at a Glance

- 7 Living in Portugal

- 8 Is Portugal a good place to live? Lifestyle in Portugal

- 9 Cost of Living in Portugal

- 10 Community in Portugal & Expat Life in Portugal

- 11 Schools in Portugal

- 12 Healthcare in Portugal

- 13 Best Places to Live in Portugal

- 14 Best Cities to Live in Portugal

- 15 Where is the Best Place to Live in Portugal as a UK Expat?

- 16 Towns in Portugal

- 17 Buying Property in Portugal

- 18 Renting in Portugal

- 19 Mortgage Portugal

- 20 Taxes in Portugal

- 21 Becoming a Portuguese Tax Resident

- 22 UK Portugal double Tax Treaty

- 23 Income Tax in Portugal

- 24 Capital Gains Tax in Portugal

- 25 Inheritance Tax in Portugal

- 26 Portuguese Wealth Tax

- 27 Tax Exemptions in Portugal

- 28 How IFICI+ Compares to NHR

- 29 How to get a Portugal Passport?

- 30 How to get Portugal Citizenship?

- 31 Portugal Permanent Residence

- 32 Financial Considerations of Residency in Portugal

- 33 Expat Wealth Management

- 34 How Expats Can Maximize Their Finances in Portugal

- 35 Portuguese Compliant Bonds

- 36 Finding the Best Forex Brokers in Portugal

- 37 Frequently Asked Questions (FAQ) on Moving to Portugal from the UK

- 38 People Also Ask

- 39 Why Choose Us?

Moving to Portugal from UK: Visas, Residency & Living Guide

Why Move to Portugal? Benefits for UK Expats

Portugal is an increasingly popular destination for UK nationals seeking a better quality of life, favourable tax conditions, and a Mediterranean climate. Whether you are emigrating to Portugal for work, retirement or investment, the country offers numerous advantages that make the transition worthwhile.

Experience Portugal: See Why Expats Love Living Here!

Thinking of moving to Portugal? Watch this video to see why thousands of UK expats choose Portugal for its warm climate, tax advantages and incredible lifestyle!

Ready to make Portugal your new home? Get expert visa and residency guidance today! Schedule a Free private Consultation. Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Why British Expats are Moving to Portugal: Key Benefits

Portugal is an appealing destination for UK nationals due to its sunny climate, affordable cost of living and attractive tax benefits. Whether you are looking to retire, work remotely or simply enjoy a better quality of life, British moving to Portugal can enjoy numerous advantages.

Can UK citizens move to Portugal after Brexit? Absolutely! Here’s why Portugal remains a top choice for British expats:

- Favourable Climate: Enjoy over 300 days of sunshine per year, offering a relaxed and outdoor-friendly lifestyle.

- Affordable Cost of Living: Compared to the UK, Portugal provides a lower cost of living, particularly in housing, groceries, and healthcare.

- Tax Benefits for Expats: The tax regime (not limited to Portugal NHR) provides significant tax incentives for new residents.

- Residency Options: UK nationals have several pathways to residency in Portugal, including the D7 Visa (Passive Income Visa), D8 Visa (Digital Nomad Visa), and Golden Visa (Investment Visa).

- Strong Expat Community: A thriving British expat community helps newcomers integrate more easily.

- Excellent Healthcare System: Portugal offers both high-quality public healthcare through SNS and accessible private healthcare options.

- Safety & Quality of Life: Portugal is ranked among the safest countries in the world, making it an ideal place to live.

- Easy Travel to the UK: Frequent flights and strong transport links ensure convenient access between Portugal and the UK.

Want to know which visa is best for you? Speak to an expert today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com for a free private consultation today!

How Easy is it to Move to Portugal from UK?

The process requires careful planning but is straightforward if you follow the correct steps. Can I move to Portugal from UK? Yes, but UK nationals need to follow these key steps:

- Step 1: Obtain a Portuguese Tax Identification Number (NIF).

- Step 2: Open a Portuguese bank account.

- Step 3: Choose a visa for Portugal from UK and apply accordingly.

- Step 4: Secure proof of residence, such as a rental or property purchase agreement.

- Step 5: Register with local authorities upon arrival.

For official post-Brexit guidance, visit the ‘UK Government’s Living in Portugal’ page.

Moving to Portugal from UK? Let our team of experts make your transition seamless. Get personalized guidance on visas, residency and relocation. Start your journey today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Challenges of Living to Portugal for UK Expats

While relocating to Portugal has many benefits, there are some challenges to consider:

Bureaucracy & Paperwork: Navigating Portuguese bureaucracy can be time-consuming, particularly for visa applications, tax registration and property purchases.

Language Barrier: While English is commonly spoken in tourist areas and among expats, dealing with government offices and local businesses may require Portuguese proficiency.

Job Market & Salaries: Portugal has a lower average salary compared to the UK, making it less attractive for professionals seeking high-paying jobs.

Cost of Living in Some Areas: While Portugal is generally affordable, Lisbon, Porto, and the Algarve have seen rent and property prices rise by 20%+ in recent years.

Public Healthcare Wait Times: Expats on the D7 and Golden Visa can access the SNS healthcare system, but waiting times for specialists can be long.

Private health insurance can help expats avoid long wait times. Get expert advice today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Moving to Portugal from UK is an exciting opportunity for those seeking a better quality of life, financial advantages, and a welcoming culture. While challenges exist, careful planning and the right visa choice make the process smoother. With the right approach, your dream of living in Portugal can become a reality!

Retiring to Portugal from UK? Our advisors can help you find the best solutions, including the right visa and financial planning strategies. Get expert advice today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

How do I move to Portugal from UK?

- Plan Your Move (3-6 months before): Research locations, finances and visa options.

- Visa Application (2-3 months before): Apply for the most suitable visa.

- Secure Accommodation (1-2 months before): Arrange a rental or purchase a home.

- Healthcare & Banking (Upon Arrival): Register with the SNS (public healthcare) and set up financial essentials.

- Residency Registration (Within 90 days of arrival): Obtain your residence permit from SEF (Immigration Services).

Moving to Portugal: Understanding Residency Options

Portugal offers multiple visa options for UK citizens looking to relocate. Whether you’re retiring, working remotely, or investing, there’s a perfect visa for you. Below, we break down the best Portugal residency visa options.

See full visa types and requirements on ‘Portugal’s official Visa Portal.’

D2 Visa Portugal (For Business Owners and Entrepreneurs)

The D2 Visa Portugal is designed for entrepreneurs, business owners, and investors looking to establish or expand a business in Portugal. Applicants must provide a detailed business plan, demonstrate financial sustainability, and contribute to the Portuguese economy.

Key Requirements:

Investment in a Portuguese business or startup.

Visa Validity:

Initially valid for 2 years, extendable for 3 more years, leading to Portugal permanent residence.

D3 Visa Portugal (For Highly Skilled Workers)

The D3 Visa Portugal is designed for highly qualified professionals, researchers and specialists seeking employment in Portugal’s high-demand sectors. It provides a fast-track route to residency and potential EU Blue Card eligibility, making it an excellent option for individuals with advanced qualifications and specialized expertise. The D3 Visa aligns well with Portugal’s Non-Habitual Resident (NHR) tax regime, offering significant tax benefits for skilled professionals relocating to Portugal. Eligible D3 visa holders can apply for NHR status, benefiting from reduced income tax rates and exemptions on foreign income for up to 10 years.

Key Requirements:

- Job Offer: A valid employment contract from a Portuguese employer for a highly skilled role.

- Professional Qualifications: A higher education degree or equivalent specialized experience in a relevant field.

- Salary Requirement: Must earn at least 1.5 times the national gross annual salary in Portugal.

- Proof of Accommodation: Evidence of a residential address in Portugal.

- Health Insurance: Private health coverage if not provided by the employer.

Visa Validity:

Initially valid for two years, extendable for an additional three years, leading to permanent residency in Portugal. After five years, applicants can apply for Portuguese citizenship.

D7 Visa Portugal (For Retirees & Passive Income Earners)

The D7 Visa Portugal is ideal for retirees and individuals with stable passive income such as pensions, rental income, or investments.

Key Requirements:

Minimum monthly income of €760 per person.

Visa Validity:

Initially granted for 2 years, renewable for 3 years, allowing a path to Portugal permanent residence.

D8 Visa Portugal (For Remote Workers & Digital Nomads)

The D8 Visa Portugal is tailored for remote workers, freelancers and digital entrepreneurs earning income from abroad.

Key Requirements:

Minimum monthly income of €3,040 from non-Portuguese sources.

Visa Validity:

1-year visa, renewable for up to 5 years, with eligibility for Portugal permanent residence.

Golden Visa Portugal (For High-Net-Worth Investors)

The Golden Visa Portugal is an investment-based residency program that provides a pathway to Portuguese citizenship.

Key Requirements:

Minimum investment of €500,000 in a Portuguese investment fund or approved projects.

Visa Validity:

Renewable residency leading to a Portugal passport after 5 years.

Summary: Visas for Portugal Options at a Glance

Want to compare all visas at a glance? See our summary table here.

Portugal HQA Visa (For Entrepreneurs, Executives and Investors)

There is also a Portugal HQA Visa program which offers entrepreneurs, investors and SMEs a streamlined route to residency in Portugal, significantly easing in-country stay requirements compared to other visas. Ideal for global executives and innovators, this program promotes investment in Portugal’s dynamic research and commercialization sectors.

Key Requirements:

- Investment starting at EUR 170,000 in qualifying innovative R&D or business projects.

- Choose between active engagement through incubation programs or passive investment options.

- Suitable for entrepreneurs, investors, executives and SMEs.

Visa Validity:

Residency under the HQA Visa is initially valid for two years, renewable for an additional three years. After five years, visa holders are eligible to apply for permanent residency or Portuguese citizenship.

Take the first step towards European residency. Contact our expert team for tailored guidance on obtaining your HQA Visa in Portugal.

Ready to apply for a visa to Portugal from UK? Let our team of experts guide you through every step of the process. Speak to an advisor today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Moving to Portugal from UK is an exciting opportunity for those seeking a better quality of life, financial advantages and a welcoming culture. While challenges exist, careful tax and financial planning and the right visa choice make the process smoother. With the right approach, your dream of living in Portugal can become a reality! Whether you are seeking retirement in the sun, a digital nomad lifestyle or an investment opportunity, Portugal offers diverse options to suit your needs. Start planning your move today and take advantage of expert guidance to make your transition seamless.

Living in Portugal

Moving to Portugal from the UK offers British nationals an appealing lifestyle, combining a warm climate, lower living costs and a welcoming expat community. Whether you are seeking a coastal retreat, vibrant city life or a peaceful countryside escape, Portugal has something to offer. What’s it like to live in Portugal? Expats frequently describe it as relaxed, sunny and culturally rich.

Why do British Nationals Choose to Live in Portugal as an expat?

Portugal has long been a favourite destination for British expats. The country offers a high quality of life, excellent healthcare and a relatively affordable cost of living compared to the UK. Many expats appreciate the relaxed pace of life, friendly locals and well-established British communities in popular towns and cities. Living in Portugal as an expat provides a unique blend of tradition and modern living.

Is Portugal a good place to live? Lifestyle in Portugal

Portugal is widely regarded as an excellent place to live, whether for families, retirees or remote workers. With its stunning coastal towns, lively cities and rich cultural heritage, the country provides a unique and balanced lifestyle. Is Portugal a good place to live? Absolutely, thanks to its affordability, safety and high standard of living.

Climate in Portugal

Portugal enjoys a Mediterranean climate, with hot, dry summers and mild winters. The Algarve boasts over 3,000 hours of sunshine per year, making it one of the sunniest regions in Europe. Coastal cities like Lisbon and Porto enjoy moderate temperatures, while inland areas can be hotter in summer and cooler in winter. Portugal coastal cities such as Faro and Lagos are highly desirable for their mild climate and stunning ocean views.

Safety in Portugal

Portugal is considered one of the safest countries in the world. According to Portugal crime statistics, the country ranks among the lowest in Europe for violent crime. Expats often highlight the sense of security they feel, whether walking through cities at night or living in rural communities.

Cost of Living in Portugal

One of the major draws for UK nationals moving to Portugal is the lower cost of living. While expenses vary by location, day-to-day costs such as groceries, dining out and transportation are generally cheaper than in the UK. Portugal retirement is popular among UK nationals due to these lower costs.

Cost of Living in Portugal vs UK

The cost of living in Portugal is significantly lower than in the UK, making it an attractive option for expats seeking affordability without sacrificing quality of life.

Housing: Rental prices in Portugal are significantly lower than in major UK cities. A one-bedroom apartment in Lisbon or Porto costs around 30-50% less than a similar property in London.

Utilities: Electricity, water and internet bills are also more affordable.

Food & Dining: Eating out is much cheaper, with a meal at a local restaurant costing around €10-€15.

Healthcare: Private healthcare and health insurance in Portugal are relatively affordable, especially compared to UK private medical care.

Compare cost of living data via the ‘OECD’s official Portugal Country Snapshot’

Community in Portugal & Expat Life in Portugal

British expats in Portugal form a well-established and active community. Many towns and cities, such as the Algarve, Lisbon, and Porto, have British-run businesses, clubs, and social groups. Expat life in Portugal is enriched by local festivals, cultural events, and a strong sense of community.

Schools in Portugal

For families moving from the UK, schools in Portugal offer various options, including public, private and international schools.

- Public Schools: Free for residents but primarily taught in Portuguese.

- Private Schools: Offer high academic standards with bilingual programs.

- International Schools in Portugal: Follow British, American or IB curriculums, making it easier for expat children to adapt.

Healthcare in Portugal

Portugal has an excellent healthcare system, ranked among the best in Europe. Expats can access both public and private healthcare services.

Health Insurance Portugal

While public healthcare is available to residents, many expats choose health insurance in Portugal for quicker access to private medical facilities. Private health insurance costs are significantly lower than in the UK and offer comprehensive coverage.

Living in Portugal as an expat offers an enviable lifestyle with great weather, a strong community and lower living costs. Whether you are drawn by the best cities in Portugal, its excellent schools, or world-class healthcare, Portugal remains one of the most attractive destinations for UK nationals. If you are considering making the move, now is the time to explore your options and secure your future in Portugal.

Best Places to Live in Portugal

Where do British expats live in Portugal? From sunny coastal retreats to buzzing city hubs, find the best place to suit your lifestyle and budget. Portugal offers a range of vibrant cities, scenic coastal towns and tranquil countryside retreats, each catering to different lifestyles. Whether you seek bustling urban life, a relaxed coastal atmosphere or an affordable yet charming town, Portugal has an ideal location for you.

Best Cities to Live in Portugal

Portugal offers a diverse range of cities, each with its own unique charm and appeal. Whether you prefer the bustling energy of a capital city, the historic attraction of an ancient town or the relaxed coastal lifestyle, Portugal has something to suit everyone. Below are some of the best cities in Portugal for expats looking to relocate.

Lisbon

Lisbon, the capital city, is a hub of culture, history, and business opportunities. Known for its stunning architecture, rich culinary scene, and vibrant nightlife, Lisbon is a popular choice for professionals and entrepreneurs. The city has an efficient public transport system, a thriving expat community, and excellent job prospects, making it one of the best cities in Portugal for professionals.

Porto

Located in northern Portugal, Porto is famous for its picturesque riverfront, historic centre, and world-renowned Port wine. Compared to Lisbon, Porto offers a lower cost of living while maintaining a high quality of life. With a growing tech industry and excellent healthcare facilities, it is an attractive option for expats looking for a balance between affordability and urban amenities.

Cascais

Cascais is a stunning coastal city known for its luxury lifestyle, beautiful beaches, and international community. With a relaxed yet sophisticated atmosphere, it is a desirable location for those considering Portugal retirement. Just a short drive from Lisbon, Cascais provides easy access to the capital while offering a more tranquil setting.

Where is the Best Place to Live in Portugal as a UK Expat?

Finding the best area to live in Portugal depends on your lifestyle, budget and personal preferences. From bustling cities to tranquil coastal retreats, Portugal offers a diverse range of living options.

Algarve

The Algarve region is renowned for its sunny climate, golden beaches and world-class golf courses. Popular among retirees and families, this area provides a laid-back lifestyle with excellent healthcare services and a low crime rate. Whether you choose bustling Albufeira, charming Tavira or picturesque Lagos, the Algarve remains a top choice for expats seeking a peaceful yet vibrant life.

Coimbra

For those looking for a more affordable yet culturally rich city, Coimbra is an excellent option. Home to one of the oldest universities in Europe, Coimbra boasts a unique blend of historical charm and modern conveniences. With a lower cost of living and excellent healthcare services, it is an attractive choice for students, professionals, and retirees alike.

Madeira

An island paradise with breathtaking landscapes and a mild climate all year round, Madeira offers a relaxed lifestyle with stunning natural beauty. Known for its lush greenery, levada walks, and vibrant festivals, Madeira is an ideal location for those who enjoy outdoor activities and scenic coastal living.

Need help choosing the perfect location? Speak to our relocation experts today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com for a free private consultation.

Towns in Portugal

For a more tranquil lifestyle, smaller towns like Sintra and Aveiro offer charm and affordability. Sintra, a UNESCO World Heritage site, is known for its fairy-tale palaces and lush forests, while Aveiro, often referred to as the “Venice of Portugal,” boasts beautiful canals and a relaxed coastal vibe.

Buying Property in Portugal

Portugal continues to attract UK nationals looking for a home in the sun — whether for relocation, retirement or as a holiday base. From coastal apartments to countryside villas, there’s a wide variety of property options to choose from. The buying process is relatively straightforward and with no restrictions on foreign ownership, it’s easy to get started.

In the sections below, we will walk you through everything you need to know about buying property in Portugal.

Buying Property in Portugal: What You Need to Know

Purchasing property in Portugal is a popular option for UK nationals looking to establish permanent residency. With relatively affordable real estate prices compared to the UK, buying a home in Portugal is an attractive investment.

Buying Real Estate in Portugal

The process of buying real estate in Portugal is straightforward but requires careful planning. It is advisable to work with a reputable real estate agent and legal expert to navigate the property market effectively.

Buying a Home in Portugal

Many expats opt for buying a house in Portugal rather than renting, as property values continue to rise. Whether you choose a modern apartment in Lisbon, a villa in the Algarve or a charming townhouse in Porto, purchasing property in Portugal can be a rewarding decision.

Renting in Portugal

If you are not ready to commit to purchasing property, renting in Portugal is a flexible and affordable alternative. The rental market varies by region, with Lisbon and Porto having higher rental costs compared to smaller towns and rural areas. Renting allows you to explore different areas before deciding on a permanent residence.

Mortgage Portugal

For those interested in buying property, securing a mortgage for Portugal is an option. Many Portuguese banks offer mortgage plans for expats, and using a Portugal mortgage calculator can help estimate monthly payments and overall costs. Understanding the financial requirements and working with a mortgage broker can simplify the process of obtaining mortgages for Portugal.

Choosing the best places to live in Portugal depends on your personal preferences, lifestyle and budget.

Ready to move to Portugal? Contact us now on Tel: +350 5600 5757 or email connect@adviceforexpats.com to make your dream a reality!

Taxes in Portugal

Understanding Taxes in Portugal

Portugal has a tax-friendly regime that attracts expatriates, especially those eligible for the Portugal NHR program. Tax residents in Portugal are taxed on their worldwide income, while non-residents only pay tax on Portuguese-sourced income.

Becoming a Portuguese Tax Resident

To become a Portuguese tax resident, an individual must meet one of the following conditions:

- Spend more than 183 days in Portugal within a 12-month period.

- Maintain a permanent home in Portugal, demonstrating intent to make it their habitual residence.

- Register with the Portuguese tax authorities and obtain a NIF (Número de Identificação Fiscal).

Portuguese Tax Return Submission Deadlines

- Annual tax returns (IRS) must be submitted between April 1st and June 30th of the following tax year.

- Late submissions may result in penalties, so timely filing is crucial.

UK Portugal double Tax Treaty

The UK Portugal double tax treaty ensures that UK nationals residing in Portugal do not pay tax twice on the same income. This agreement benefits expats by clarifying tax liabilities between both countries.

Income Tax in Portugal

Income tax in Portugal follows a progressive system, ranging from 14.5% to 48%, depending on income levels. Expats benefiting from the Portugal NHR scheme may enjoy reduced tax rates for certain income types.

Capital Gains Tax in Portugal

Capital gains in Portugal are taxed at 28% for individuals and 25% for corporations. However, primary residences are eligible for capital gains tax exemptions on sale of the main property if reinvested in another home.

Inheritance Tax in Portugal

Unlike the UK, inheritance tax in Portugal is not levied on direct heirs (spouses, children). Other beneficiaries pay 10% stamp duty on inherited assets.

Portuguese Wealth Tax

Portugal levies a wealth tax (Adicional ao IMI) of 0.3% to 1% on real estate holdings exceeding €600,000.

Tax Exemptions in Portugal

Portugal Nhr

The Portugal Non-Habitual Resident (NHR) scheme has recently undergone significant changes, making it more restrictive. Previously offering broad tax exemptions, the scheme now focuses on individuals engaged in scientific research or projects that contribute economic value to Portugal.

- The flat 10% tax rate on foreign pension income remains, but eligibility is now more stringent.

- Tax exemptions on foreign-sourced income are being phased out for most new applicants.

- The scheme now prioritizes individuals who bring scientific or economic benefits to Portugal, aligning with the country’s long-term growth strategy.

Despite these changes, the NHR scheme still provides valuable tax incentives for qualifying expats.

Nhr Portugal February 2025 Update

On February 13, 2025, Portugal’s investment agencies AICEP and IAPMEI defined the strategic industries qualifying under the Recognized Activity Route.

How to Qualify

To benefit individuals must engage in an eligible profession under one of these four entry routes:

- Qualified Start-up Route: For entrepreneurs launching innovative businesses.

- Qualified Investment Route: For investors supporting Portugal’s economy.

- Industrial/Service Export Route: For businesses exporting goods or services.

- Recognized Activity Route: Now expanded to include more sectors and professions.

Full details available ‘AICEP Official Notice’

Key Changes

- Expanded Sectors: Covers hospitality, corporate headquarters, fund services, administrative support and restricted consultancy.

- Wider Professional Scope: Open to professionals with technical or applied expertise.

- Strategic Projects Eligible: Includes National Interest Projects (PIN) and Interior Investment Projects (PII).

How IFICI+ Compares to NHR

While more restrictive than NHR, IFICI+ still offers major tax benefits, including:

- 20% flat tax on eligible income for 10 years.

- No tax on most foreign income, including capital gains on securities.

- No inheritance or wealth tax.

- Crypto-friendly regime with no taxation on digital assets.

With its pro-business approach, IFICI+ presents significant opportunities for entrepreneurs, family offices and HNWIs seeking a tax-efficient relocation to Portugal.

Get in touch to explore your options under IFICI+! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Capital Gains Tax Exemptions on sale of main property

Portugal provides capital gains tax exemptions for individuals selling their main residence under specific conditions:

- The proceeds from the sale must be reinvested in another primary residence within Portugal or the EU/EEA within 36 months.

- If the seller is retired or over 65, reinvestment in a qualifying financial product (e.g., pension schemes) may also qualify for exemption.

- Partial exemptions may apply depending on reinvestment amounts and timing.

These exemptions make Portugal a tax-efficient jurisdiction for homeowners looking to sell and reinvest without excessive tax burdens.

Portugal Crypto Tax

From 2023, Portugal introduced a Portugal crypto tax of 28% on short-term gains (crypto held under one year), while long-term holdings remain tax-free.

Tax Efficiency of Pension Income Drawdown

Under the 85/15 rule, 85% of pension income can be withdrawn tax-free as a lump sum, while the remaining 15% is subject to Portuguese income tax. However, those eligible for the Portugal NHR (Non-Habitual Resident) scheme may benefit from significantly reduced tax rates, making Portugal a highly attractive destination for retirees looking to optimize their pension income and minimize tax liabilities.

This system makes Portugal an attractive destination for retirees looking to maximize their pension income while minimizing tax liabilities.

Learn more about ‘Tax Planning Services for UK Expats.’

Wondering how much tax you will pay in Portugal? Our expert advisors can help you understand your tax liabilities and optimize your finances. Get in touch today! Call us today on Tel: +350 5600 5757 or Email connect@adviceforexpats.com

How to get a Portugal Passport?

Want to gain full EU residency rights? A Portugal passport allows you to live, work and travel visa-free across Europe. Here’s how to get one.

Portugal Passport Benefits

How powerful is the Portugal passport ranking?

A Portugal passport ranking is among the highest in global mobility offering:

- Visa-Free Travel: Portugal passport holders can enter 190+ countries, including the USA, Canada and Australia, without a visa.

- The ability to live, work and study anywhere in the EU.

- Strong protections and rights under Portuguese and EU law.

Once you acquire a Portugal passport, you gain access to one of the most powerful passports in the world. Portugal passport visa-free countries include all EU countries and many others across the globe, making it an extremely valuable travel document.

Portugal passport holders can travel freely within the Schengen Area, as well as to countries such as the United States, Canada, Australia, and many others, with no need for a visa. This provides exceptional flexibility for both business and leisure travel.

How to get Portugal Citizenship?

To qualify for Portugal citizenship, you generally need to:

Hold a Portugal residency visa and maintain legal residence for five years.

Demonstrate basic proficiency in Portuguese.

Show integration into the local community.

Have a clean criminal record.

Portugal Permanent Residence

After meeting the residency requirement for the citizenship process, you may be eligible for Portugal permanent residence. This allows you to stay in Portugal indefinitely while enjoying the benefits of Portuguese residency.

To apply for permanent residence, you must show proof of continuous legal residency and financial stability. Permanent residents can work, live and study in Portugal without the need for a visa.

Learn more about our ‘Global Mobility Services.’

Want to secure your Portugal passport? We will guide you through the residency and citizenship process. Start today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Financial Considerations of Residency in Portugal

When you decide to move to Portugal from the UK, one of the most critical aspects to consider is your financial planning.

Comprehensive Financial Management

Effective financial planning is essential for anyone looking to relocate to Portugal. Whether you are retiring, starting a business, or working remotely, it’s crucial to understand the financial landscape of your new country of residence. Portugal has a robust financial sector, but its tax regulations and investment opportunities differ significantly from those in the UK. Therefore, working with a financial advisor who understands both UK and Portuguese tax systems is advisable.

Expat Wealth Management

Managing wealth as an expat in Portugal presents unique challenges and opportunities. It’s essential to balance your financial goals with Portugal’s regulations on taxation and wealth management.

Expat wealth management in Portugal includes:

- Taxation for Expats: Portugal provides some of the most favourable tax incentives in Europe, especially for retirees or those on passive income. As an expat, understanding your tax liabilities—such as capital gains tax in Portugal and inheritance tax Portugal—is critical to optimizing your wealth.

- Estate Planning: Consider how your wealth will be distributed according to Portuguese inheritance laws and the impact of inheritance tax in Portugal or the UK.

Learn more about our ‘Estate Planning Services’ - Currency Management: With currency fluctuations, it’s essential to manage your finances effectively, particularly if you are bringing in income or assets from the UK. Ensuring you get the best exchange rates is crucial in protecting your wealth.

How Expats Can Maximize Their Finances in Portugal

If you are emigrating to Portugal, financial planning will be one of your most important tasks. A well-structured financial plan will ensure that your retirement, investment and everyday expenses align with your long-term goals. Key elements of financial planning for expats in Portugal include:

- Income Sources: Ensure that your income—whether from employment, business or retirement—is optimally structured for tax efficiency. Consider strategies such as using Portugal’s NHR to reduce income tax liabilities.

- Debt Management: Moving abroad often means making financial decisions around UK mortgages, loans and credit. It’s vital to have a plan in place for managing any remaining debt while optimizing your cash flow in Portugal.

- Healthcare and Insurance: Don’t forget to include healthcare coverage in your plan. Portugal offers excellent public healthcare, but private insurance is also a wise choice, especially for expats who may need faster services.

Worried about managing your wealth in Portugal? Get expert financial planning advice today! Call us on Tel: +350 5600 5757 or Email connect@adviceforexpats.com

Portuguese Compliant Bonds

For UK nationals moving to Portugal, managing your wealth efficiently and in a tax-compliant way is essential. One financial product that is often recommended for expats is the offshore bond, specifically a Portuguese-compliant offshore bond, such as those issued by Utmost in Ireland. These bonds are specifically designed to meet the tax requirements of Portugal while offering significant flexibility for expats who are managing their finances across borders.

Learn more about our ‘Wealth Management Services.’

Finding the Best Forex Brokers in Portugal

Transferring money between the UK and Portugal? Choosing the right forex broker can save you thousands on exchange rates and fees. The best currency brokers offer:

- Competitive Exchange Rates: You will want a broker who can provide favourable rates, especially if you are transferring large sums of money from the UK.

- Low Fees: High fees can quickly eat into your savings when exchanging currencies. Look for brokers that offer transparent and low-cost services.

- Online Tools and Accessibility: A good forex broker should provide you with easy access to currency exchange tools and resources that allow you to manage your funds effectively.

Learn more about our ‘Currency Exchange Services.’

Get the best exchange rates for your money transfers—speak to our forex specialists today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Why Use a Forex Broker?

Using a forex broker in Portugal is crucial for efficiently managing your finances, particularly if you are bringing assets over from the UK or other countries. Some key reasons to use a forex broker include:

- Favourable Exchange Rates: Forex brokers typically offer more competitive rates than traditional banks or currency exchange offices, saving you money on international transfers.

- Flexible Currency Options: Forex brokers offer a wider range of currencies for exchange, ensuring that you can manage all your international transactions smoothly.

- Expert Advice: Good forex brokers offer expert guidance, helping you navigate the complexities of currency exchange, especially when dealing with the volatile GBP-EUR exchange rate.

Call now on Tel: +350 5600 5757 or Email us at connect@adviceforexpats.com for personalized guidance on managing your wealth and investments in Portugal.

Frequently Asked Questions (FAQ) on Moving to Portugal from the UK

Still have questions about moving to Portugal? Here are the answers to the most common concerns expats have?

Moving to Portugal from the UK requires choosing the right visa. UK nationals can apply for the D7 visa (passive income route), D8 visa (digital nomad visa) or the Golden Visa (investment-based). Once in Portugal, you must obtain a residence permit and register with local authorities.

To emigrate to Portugal, apply for a long-term visa, secure health insurance and register with the tax authorities. UK nationals typically start with a temporary residency permit, which can lead to permanent residency after five years.

Yes, many UK pensioners retire to Portugal due to its warm climate and low cost of living. The D7 visa is the most popular option for retirees. Portugal’s healthcare system is excellent and there are tax advantages available to retirees.

Compared to the UK, Portugal offers a lower cost of living, especially in housing, groceries and dining. However, Lisbon and the Algarve can be pricier. Understanding local expenses will help in financial planning.

Portugal does not impose inheritance tax on direct family members (spouses, children and parents). However, other heirs may face a 10% stamp duty on inherited property.

To obtain Portugal citizenship, you must legally reside in Portugal for at least five years. You must also pass a basic Portuguese language test and meet Portugal citizenship requirements, including proving ties to the country.

Portugal immigration news frequently changes. The NHR tax regime ended in 2024, but other tax-efficient strategies remain. Stay updated with professional advice to ensure compliance.

UK nationals can apply for:

- D7 Visa (passive income)

- D8 Visa (digital nomads)

- Golden Visa (investment)

- HQA Visa Portugal (investment)

- Job-seeker and student visas

Portugal offers a high quality of life, a favourable tax system and a welcoming expat community. Its pleasant climate, affordable healthcare and thriving cities make it one of the best destinations for UK nationals.

Ready to make Portugal your new home? Get expert guidance on visas, residency and finances—start your journey to Portugal today! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

People Also Ask

You will typically need at least €8,000–€12,000 per person to cover visa requirements, relocation costs and 3–6 months of living expenses in Portugal.

The easiest way for UK citizens is the D7 Visa, which suits retirees and passive income earners. It has low entry requirements and leads to permanent residency.

Yes, you can move to Portugal without a job using the D7 Visa or Digital Nomad Visa, as long as you meet the income and accommodation requirements.

Why Choose Us?

At Advice for Expats, we cut through the complexity of moving to Portugal. Our expert network ensures you get the right visa, tax planning, and financial guidance—all tailored to your needs. With us, you avoid costly mistakes and fast-track your dream life in Portugal.

Start Your Journey Today!

Make your move smooth, stress-free, and financially smart with expert support every step of the way. Don’t leave your future to chance—contact us now!

If you require advice, you can arrange a free initial financial consultation with a trusted expert on:

Telephone: +350 5600 5757

Email: connect@adviceforexpats.com