- 1 Moving to Spain from UK: Visas, Residency & Living Guide

- 2 Advantages of Moving to Spain from UK

- 3 7 Biggest Mistakes When Moving to Spain

- 4 Moving to Spain: Understanding Residency Options

- 5 Summary: Spain Visa Options at a Glance

- 6 Living in Spain

- 7 Lifestyle in Spain

- 8 Cost of Living in Spain

- 9 Schooling in Spain

- 10 Community in Spain & Expat Life in Spain

- 11 Healthcare in Spain

- 12 Best Places to Live in Spain

- 13 Taxes in Spain

- 14 Becoming a Spanish Tax Resident

- 15 Income Tax in Spain

- 16 Dividend Tax in Spain

- 17 Capital Gains Tax in Spain

- 18 Succession Tax in Spain

- 19 Spanish Wealth Tax

- 20 Beckham Law Spain

- 21 Financial Considerations of Retirement in Spain

- 22 Finding the Best Forex Brokers in Spain

- 23 Frequently Asked Questions (FAQ) on Moving to Spain from UK

- 24 People Also Ask

- 25 Why Choose Us?

Moving to Spain from UK: Visas, Residency & Living Guide

Why Move to Spain? Benefits for UK Expats

Thinking about a new life in Spain? Enjoy year-round sunshine, lower living costs, and an easy going Mediterranean lifestyle. UK nationals looking to move to Spain from UK can benefit from vibrant culture, excellent healthcare and strong expat communities. Whether for retirement in Spain, career opportunities or investment, Spain offers an attractive option for many.

Spain is a top choice for British citizens, with thousands making the move each year. The Spain residency process may seem complex post-Brexit, but with proper guidance, it is entirely achievable.

Experience Life in Spain: See Why Expats Love It!

Thinking about moving to Spain? Watch this video to see why thousands of UK expats choose Spain for its amazing lifestyle, lower cost of living and Mediterranean charm!

Ready to start your new life in Spain? Get expert residency & relocation guidance today! 📞 Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com to get a Free Private Consultation Now!

Advantages of Moving to Spain from UK

But what makes Spain the perfect choice for UK nationals? Let’s explore the key benefits:

- Living in Spain provides a relaxed Mediterranean lifestyle with warm weather, a strong sense of community and access to beautiful coastal and inland landscapes. Outdoor activities, including hiking, sailing, and golf are available year-round.

- Lower Cost of Living: Rent is 30-50% cheaper than in London. Groceries & dining 20-40% cheaper than the UK.

- Additionally, tax incentives, such as the Beckham Law Spain, make it an attractive destination for executives, entrepreneurs, and high-net-worth individuals.

- Residency Options for UK Nationals: Multiple visa pathways available, including the Non-Lucrative Visa (for retirees) & Digital Nomad Visa (for remote workers. Relocating to Spain is simplified with professional residency consultation services that guide applicants through legal processes and documentation.

- World-Class Healthcare: Public & private healthcare options available. Private insurance costs start at €50/month. Expats can access medical insurance Spain to supplement public healthcare, ensuring comprehensive coverage.

- Spain has a strong community of British expats in Spain, creating a welcoming and supportive environment for newcomers. From local social groups to online communities, expats can easily connect with like-minded individuals and integrate into Spanish society.

- Spain’s well-connected transport network allows ease of travel to the UK and other European destinations. Major international airports in Madrid, Barcelona and Malaga offer direct flights to UK cities, making it convenient for frequent travellers.

- Diverse Property Market: The Spanish property market provides various options, from affordable countryside homes to luxury beachfront villas. Many UK nationals choose to buy a place in Spain as an investment or holiday home, benefiting from the country’s stable real estate market.

- Retirement in Spain is a popular choice due to the country’s warm climate, affordable living and excellent healthcare system. Many UK retirees opt for regions like Costa del Sol and Alicante, where English-speaking services and expat communities are abundant.

Want to discuss your Spain residency options? 📞 Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com for a free private consultation today! Limited Spots Available!

Learn more about the best places to live in Spain here.

7 Biggest Mistakes When Moving to Spain

While moving to Spain from UK is an exciting opportunity, many expats encounter challenges along the way. Avoiding these common mistakes can make your transition smoother and ensure a successful relocation.

Spain Visa Requirements Post Brexit: That Uk Nationals Must Read! Post-Brexit, UK nationals require a Spain visa from UK for stays beyond 90 days.

Underestimating the Cost of Living: While Spain living costs are lower than the UK, expenses can vary significantly by region.

Ignoring Spanish Tax Rules:

Once in Spain 183+ days/year, you’re a tax resident & must declare global income.

Failing to Learn the Language: Although many Spaniards speak English, fluency in Spanish is a major advantage.

Choosing the Wrong Location: Not all areas suit expats; researching best places to live in Spain is essential.

Not Securing Health Insurance: Private health insurance Spain is advisory for most residency visas.

Not Getting Expert Help: Moving to Spain involves legal and tax complexities. A residency consultant can help you avoid costly errors.

Avoid costly mistakes! Speak to a Spain relocation specialist for a smooth move.

Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Moving to Spain: Understanding Residency Options

For UK nationals moving to Spain, securing the appropriate Spain residency permit is essential. Whether you’re a retiree, a remote worker, an entrepreneur, or a highly skilled professional, there are several Spain visa options available. Below are the key residency pathways for British expats in Spain after Brexit.

You can also refer to the ‘Official UK Government Guidance on Living in Spain’ for up-to-date legal and residency information.

Spanish Non-Lucrative Visa (For Retirees & Passive Income Earners)

The Spanish Non-Lucrative Visa is ideal for UK nationals who want to retire or live in Spain without working. This visa allows residency as long as you can prove financial independence.

Key Requirements:

- Financial proof: Minimum 400% of IPREM annually (€28,800 per year in 2024).

- Health insurance: Must have private health insurance covering all medical expenses in Spain.

- Employment restrictions: Cannot work or run a business in Spain.

- Clean criminal record: Required from all countries of residence in the last 5 years.

- Medical certificate: Must prove you are free from contagious diseases.

Pathway to Permanent Residency is 5 years.

Full visa criteria and application processes are available from ‘Spain’s Ministry of Interior.’

How long is the visa valid?

Initially valid for 1 year, renewable for 2 years, leading to permanent residency after 5 years.

Digital Nomad Visa Spain (For Remote Workers & Freelancers)

The Spain Digital Nomad Visa allows UK nationals to live in Spain while working remotely for non-Spanish companies. This is ideal for freelancers, remote employees and self-employed professionals.

Key Requirements:

- Employment type: Must work for a non-Spanish company or freelance with international clients.

- Financial proof: Earn at least 200% of IPREM per month (€2,400/month in 2024).

- Health insurance: Must have comprehensive private medical insurance.

- Professional experience: Must prove 3+ years of work experience or hold a university degree.

How long is the visa valid?

Initially issued for 1 year, renewable for up to 5 years. Eligible for permanent residency after 5 years.

Entrepreneurs Visa Spain (For Business Owners and Investors)

The Spain Entrepreneur Visa is designed for UK nationals who want to start a business in Spain. The business must be innovative and have a positive economic impact.

Key Requirements:

- Business plan: Must present a detailed business plan approved by Spain’s Directorate of Trade & Investment.

- Financial proof: Must show sufficient capital to fund the business.

- Economic benefit: Business must create jobs or contribute to Spain’s economy.

- Health insurance: Private health insurance required.

How long is the visa valid?

Issued for 1 year, renewable based on business performance. Leads to permanent residency after 5 years.

Highly Qualified Professional Visa Spain (For Skilled Workers)

The Spain Highly Qualified Professional Visa is designed for UK nationals with a job offer from a Spanish company in a specialized sector such as technology, finance, or healthcare.

Key Requirements:

- Job offer: Must have a contract from a recognized Spanish company.

- Salary threshold: Salary must meet minimum required levels (varies by industry).

- Qualifications: Must have a relevant university degree or proven work experience.

- Health insurance: Private health insurance required.

How long is the visa valid?

Issued for 2 years, renewable. Leads to permanent residency after 5 years.

By selecting the right Spain residency permit, British expats in Spain can enjoy a smooth transition into their new life abroad. Seeking professional residency consultation can further streamline the application process and increase approval success rates.

Not sure which visa is right for you? Let us guide you through your Spain residency options. Get a free private consultation now! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

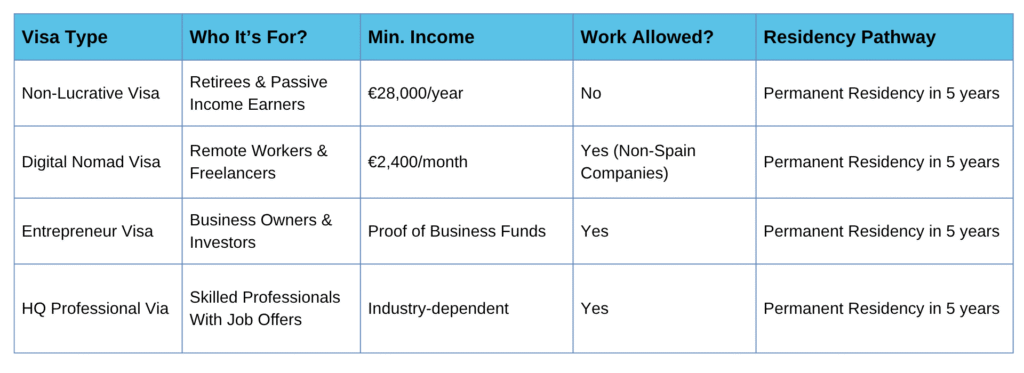

Summary: Spain Visa Options at a Glance

Want to compare all visas at a glance? See our summary table here.

Learn more about our ‘Global Mobility Services.’

Living in Spain

Why do British Expats Choose to Live in Spain?

For many UK nationals, the appeal of living in Spain after Brexit remains strong. Spain offers an excellent quality of life, fantastic weather and a welcoming atmosphere for British expats in Spain. The process of relocating to Spain has changed due to Brexit, but UK nationals can still live in Spain with the right Spain residency permit.

Lifestyle in Spain

Spain is renowned for its vibrant culture, delicious cuisine and relaxed work-life balance, making it an appealing destination for UK nationals seeking a better quality of life. The Mediterranean lifestyle is deeply ingrained in Spanish society, where social interactions, outdoor activities and family values play a crucial role.

Climate in Spain

One of the major attractions of living in Spain is its incredible climate. The climate in Spain varies by region, but generally, it offers hot summers, mild winters and plenty of sunshine throughout the year. The Mediterranean coastline, including Costa del Sol and Alicante, experiences warm temperatures, making it perfect for outdoor activities and relaxation. Whether it’s enjoying the beach lifestyle, hiking in the Sierra Nevada, or sipping wine at a seaside café, the weather in Spain allows for a more active and enjoyable lifestyle.

Safety in Spain

Safety in Spain is another key consideration for UK nationals moving abroad. Spain consistently ranks as one of the safest European countries, with low crime rates and a strong police presence. The country maintains high safety standards in both urban and rural areas, making it a secure place for families, retirees and professionals. Whether in major cities like Madrid and Barcelona or quieter coastal towns, residents benefit from well-maintained public spaces, effective law enforcement, and a general sense of security.

The lifestyle in Spain offers a perfect blend of relaxation, culture, and adventure, making it one of the most attractive destinations for British expats. From its favourable climate and high safety standards to its rich culinary traditions and thriving social scene, Spain provides an exceptional quality of life for those looking to relocate and settle in a vibrant, welcoming country.

Cost of Living in Spain

Spain offers a significantly lower cost of living than the UK, particularly in housing, dining, and transportation. Many expats find that they can enjoy a high-quality lifestyle for much less.

For detailed data, consult the official Spanish statistics on cost of living published by the ‘Instituto Nacional de Estadística.’

Cost of Living in Spain vs UK

- Rent:

Madrid (€1,000/month) vs. London (£2,000/month): Save 50%! - Dining Out:

Spain (€12 meal) vs. UK (£18 meal): Save 30%! - Transport:

Madrid Metro (€55/month) vs. London (£200/month): Save 70%!

Groceries & Dining: 20-40% cheaper than in the UK. A meal at a mid-range restaurant costs around €12, compared to £18 in the UK.

Public Transport: Monthly metro pass: Madrid (€55) vs. London (£200+). A taxi ride in Spain is on average 30% cheaper than in the UK.

Utilities & Internet: Electricity bills range from €60-€100/month depending on location, compared to £150+ in the UK. Internet plans in Spain start from €30/month.

Spain’s overall cost of living allows expats to enjoy a comfortable lifestyle at a lower price.

Find out which Spanish city fits your budget. Get a personalized cost-of-living consultation! Call us now on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Schooling in Spain

For families relocating, schooling in Spain is an important factor. Spain offers a range of educational options, including public, private, and international schools. International schools are popular among expats as they provide British, American, or IB curriculums, easing the transition for children.

Community in Spain & Expat Life in Spain

Spain has a well-established expat community, particularly in regions like Costa Blanca, Costa del Sol and Barcelona. British expats in Spain benefit from a strong support network, including expat clubs, networking groups and social gatherings. This makes living in Spain easier and more enjoyable.

Healthcare in Spain

The healthcare in Spain system is among the best in the world, with both public and private services offering high-quality medical care. Expats moving to Spain should consider securing health insurance in Spain to access private healthcare facilities, which provide shorter wait times and English-speaking medical professionals.

Looking for the best expat health insurance in Spain? Let us help you find the right plan! Contact us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Medical Insurance Spain

Having medical insurance Spain is essential for expats who are not covered under Spain’s public healthcare system. Private health insurance Spain ensures access to top-tier healthcare services and is often a requirement for residency applications.

By understanding these key aspects of living in Spain, UK nationals can make informed decisions and enjoy a seamless transition into their new life abroad.

Best Places to Live in Spain

Spain has something for everyone, whether you prefer the energy of a big city, the relaxed pace of a coastal town or the charm of a countryside retreat. The best places to live in Spain vary depending on lifestyle preferences, climate and affordability. Below are some of the most popular destinations for expats looking to relocate.

Great Places to Live in Spain

From vibrant cities to tranquil coastal regions, Spain offers a diverse range of locations suited to different lifestyles. Whether you are looking for a bustling urban environment, a laid-back beachside town or a scenic rural retreat, Spain has plenty of great options for expats. Below are some of the best places to live in Spain for UK nationals looking to settle in the country.

Best Cities to Live in Spain

Spain’s cities offer a mix of vibrant culture, modern amenities, and rich history, making them attractive destinations for expats. Whether you’re looking for a fast-paced urban environment, a coastal city with stunning beaches, or a relaxed and affordable alternative, Spain has a city to suit every lifestyle.

Madrid

For those who thrive in a bustling metropolis, Madrid is often considered the best place to live in Spain. As the capital, it offers world-class amenities, international schools, cultural attractions and strong job opportunities. The city is home to a large expat community, making integration easy.

Barcelona

Barcelona is another great place to live in Spain, combining stunning architecture, Mediterranean beaches and a dynamic business environment. Expats who enjoy a balance of city life and coastal living will find Barcelona an ideal choice.

Valencia

Valencia is gaining popularity as one of the best regions to live in Spain due to its affordable housing, excellent healthcare and fantastic climate. With a slower pace of life than Madrid or Barcelona, it is perfect for families and retirees.

Best Regions to Live in Spain

Spain offers a variety of regions that appeal to expats, from sun-drenched coastal areas to charming countryside retreats. Whether you’re looking for a lively expat community, stunning natural scenery, or a quiet place to settle, these regions stand out as some of the best places to live in Spain.

Costa del Sol

The Costa del Sol is one of the best places to live in Spain for retirees and expats seeking year-round sunshine and a strong English-speaking community. Malaga, Marbella and Estepona are top choices for expats looking for Spanish property along the coast.

Alicante

Alicante is a great place to live in Spain for expats seeking an affordable cost of living, excellent transport links and vibrant nightlife. It is also a hotspot for those interested in buying a place in Spain at a reasonable price.

Mallorca

Mallorca offers a high quality of life and is regarded as one of the best places to live in Spain for those looking for an island paradise. The property in Spain market on the island includes everything from traditional fincas to modern villas.

Buying Property in Spain

Whether you are considering buying a home in Spain for investment, retirement or relocation, Spain has a diverse property market. From city apartments to beachfront villas, buying a property in Spain offers plenty of options for all budgets.

- Spanish property prices vary by region, with Madrid and Barcelona being the most expensive.

- The Costa del Sol, Alicante and Valencia provide more affordable options for expats looking for a home for sale in Spain.

- Understanding the legal process of home purchase Spain is crucial, and hiring a professional to assist with buying a place in Spain is advisable.

Whether you are searching for Spanish property as an investment, considering buying a home in Spain for permanent residency or simply exploring the best places to live in Spain, careful research and professional advice can make your relocation smoother.

Looking for the best expat health insurance in Spain? Let us help you find the right plan! Contact us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Taxes in Spain

Understanding Taxes in Spain

For UK nationals moving to Spain, understanding taxation in Spain is essential to ensure tax compliance and avoid unexpected tax liabilities. Taxes in Spain operate on a residency-based system, meaning that individuals who become Spanish tax residents are subject to tax on their worldwide income. The UK-Spain double tax treaty helps prevent double taxation, ensuring that income is only taxed once in the appropriate jurisdiction.

Becoming a Spanish Tax Resident

A Spanish tax resident is someone who spends more than 183 days per year in Spain or has their centre of economic and vital interests in the country. The Spanish tax year runs from 1st January to 31st December and residents must file an annual tax declaration Spain covering all global income. High-net-worth individuals must also comply with Modelo 720 Spain, a declaration of overseas assets exceeding €50,000.

Income Tax in Spain

Income tax Spain applies to all Spanish tax residents on their global earnings. Tax bands Spain are progressive, starting at 19% and increasing to 47%, depending on income levels. Various deductions are available, including allowances for pensions and dependents. Many expats use a ‘Spanish Tax Calculator’ to estimate their tax liability before filing.

For more details, please use the ‘Spanish Tax Calculator’

Dividend Tax in Spain

For those receiving dividend income, dividend tax in Spain is an important consideration. Residents in Spain pay 19% to 26% tax on dividend earnings, depending on the total amount received. The UK-Spain double tax treaty helps prevent dual taxation, allowing UK expats to offset some taxes paid in the UK against their Spanish liabilities.

Capital Gains Tax in Spain

Selling a property or other assets in Spain or elsewhere may trigger capital gains tax Spain. The rates range from 19% to 28%, depending on the amount of profit made. Certain exemptions apply, such as reinvesting proceeds into another primary residence.

Succession Tax in Spain

Succession tax Spain applies to inheritances received in Spain, with rates varying by region. While close relatives may benefit from tax exemptions, non-resident heirs could face higher taxation. Estate planning is crucial for expats to mitigate unexpected liabilities.

Spanish Wealth Tax

For individuals with significant assets, Spanish wealth tax is levied on net worldwide wealth, starting from 0.2% to 3.5%, depending on the region. The tax applies to both tax residents and non-residents with wealth in excess of €3 million in regions where significant tax deductions or 100% exemptions apply.

Beckham Law Spain

The Beckham Law Spain is a tax regime designed to attract highly skilled foreign workers, including expats relocating for employment. Under the Beckham Law Spain, qualifying individuals can opt to be taxed as non-residents for up to six years, paying a flat 24% tax rate on Spanish earnings up to €600,000, rather than the progressive rates applied to residents. It is also worth noting that certain types of foreign income such as cgt Spain, dividend tax Spain and inheritance tax in Spain are exempt under this law.

Learn more about our ‘Tax Planning Services.’

Worried about Spanish taxes? Speak to a tax expert today! Contact us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Financial Considerations of Retirement in Spain

Comprehensive Financial Management

Planning for retirement in Spain requires comprehensive financial management to ensure long-term financial security. Expats need to consider taxation, pensions, investments and estate planning to make informed decisions about their financial future.

Expat Wealth Management

Effective wealth management is crucial for expats looking to optimize their assets while living in Spain. Expat wealth management focuses on tax-efficient investment strategies, wealth preservation, and estate planning. A certified wealth manager can help expats structure their portfolios to align with Spanish regulations and financial goals. Portfolio management ensures a balanced investment approach that mitigates risks and enhances long-term returns.

Pensions in Spain

Understanding pensions in Spain is vital for UK nationals retiring abroad. Recent changes in the UK Autumn Budget 2024 have significantly impacted QROPS Spain, making them less viable due to a 25% overseas transfer charge (OTC). Furthermore, Spain now taxes non-EU pensions at the point of transfer as income tax, further reducing the benefits of QROPS Spain. As a result, the best alternative is an International SIPP, which offers greater tax efficiency and flexibility for UK expats managing their UK pensions in Spain.

Learn more about our ‘Pensions Services.’

Financial Planning for Expats

Expats moving to Spain should seek guidance from a certified financial advisor to ensure smart financial decisions. Expert financial planning can help with investment planning, tax mitigation, and long-term retirement strategies. Expat financial advice from a personal financial specialist ensures that UK nationals structure their finances efficiently, helping them maintain financial security in Spain.

Spanish Compliant Bonds

A Spanish compliant bond is one of the most tax-efficient investment solutions for expats in Spain. Unlike traditional investments, Spanish compliant bonds offer favourable tax treatment, deferring tax liability until withdrawals are made. Often referred to as a Spanish ISA or Spanish bond, this investment vehicle is recognized by Spanish tax authorities, making it an attractive option for wealth management. A Spanish compliant investment bond provides flexibility in accessing funds while ensuring compliance with local tax laws.

Learn more about our ‘Wealth Management Services.’

Finding the Best Forex Brokers in Spain

Spain offers a wide range of forex brokers and currency exchange providers, from local banks to specialist foreign exchange companies. While banks may offer convenience, they often come with higher fees and less competitive exchange rates. Dedicated conversion fx specialists and money exchange services provide better rates and lower commissions, making them a preferred choice for expats and businesses.

Look for providers that offer transparent pricing, minimal service fees and fast transactions. Many FX services in Spain now offer online conversion FX tools, allowing you to check live exchange rates before making a transaction.

Learn more about our ‘Currency Exchange Services.’

Want to save on currency exchange? Compare the best forex rates today! 📞 Call us on Tel: +350 5600 5757 or 📧 Email: connect@adviceforexpats.com

Why Use a Forex Broker?

For those making significant financial transfers—such as purchasing property, moving pensions or sending money internationally — working with a forex broker can be highly beneficial. They offer:

- Better exchange rates than banks.

- Lower transfer fees.

- Hedging strategies to protect against currency fluctuations.

- Fast and secure transactions.

Get the Best Rates Today!

If you need money exchange services in Spain, don’t settle for high bank fees. Explore trusted forex brokers and currency exchange specialists to get the most competitive rates. Start saving now by finding the best money exchange services near you!

Frequently Asked Questions (FAQ) on Moving to Spain from UK

Yes! UK nationals can move to Spain with visas like the Non-Lucrative Visa (retirees), Digital Nomad Visa (remote workers) or Entrepreneur Visa (business owners). Each has unique requirements.

Speak to a residency expert for details! Call us on Tel: +350 5600 5757 or Email: connect@adviceforexpats.com

Yes, UK citizens can move to Spain permanently by obtaining legal residency in Spain. Initially, most visas grant temporary residence, but after five years of continuous stay, expats can apply for permanent residency in Spain. After ten years, it is possible to apply for Spanish citizenship, provided all residency and tax obligations are met. Understanding the different Spain residency permits available is key to making a smooth transition.

Currently, Spain follows the Schengen Zone 90-day rule, meaning UK nationals can only stay for 90 days in any 180-day period without a visa. There has been speculation about changes to this rule, but no official modifications have been announced. If you plan to stay longer, you must apply for a Spain visa from the UK, such as the Non-Lucrative Visa, Digital Nomad Visa, or another residency permit.

If you become a Spanish tax resident, you will be taxed on your worldwide income. Spain applies progressive income tax rates, capital gains tax, and wealth tax for individuals with over €3 million in assets. The UK-Spain double tax treaty helps avoid double taxation, and non-residents are only taxed on Spanish-sourced income.

Spain is generally more affordable than the UK, especially for housing, food and transport. Rent and property prices can be 30-50% lower than in major UK cities, with a one-bedroom apartment in Madrid costing around €1,000 per month, compared to more than £2,000 per month in London. Groceries and dining out are 20-40% cheaper and public transport is significantly more affordable, with a monthly metro pass in Madrid at €55 versus +£200 in London. Utilities and healthcare costs are also lower, offering a higher quality of life at a lower price.

Still have questions about moving to Spain? Get expert answers from our team today! Call us on Tel: +350 5600 5757 or Email us at connect@adviceforexpats.com

People Also Ask

Popular choices include Costa del Sol, Alicante, Valencia and Mallorca — all offer sunshine, English-speaking services, and strong expat communities.

You will typically need around €28,800 per year to qualify for a Non-Lucrative Visa in 2024, plus extra for dependents and health insurance.

Yes, UK pensioners can move to Spain using the Non-Lucrative Visa and may transfer pensions to an International SIPP or draw directly from the UK.

If you are a Spanish tax resident, you pay tax in Spain on your worldwide income. The UK-Spain tax treaty prevents double taxation in most cases.

Why Choose Us?

At Advice for Expats, we understand that managing your finances as a British expat in Spain requires expert guidance. Our network of certified financial advisors, chartered financial planners and investment specialists provides tailored strategies to optimise your tax position, grow your wealth and protect your assets. Whether you’re looking for expat wealth management, portfolio management, investment advice, or tax-efficient financial planning, our panel of trusted advisers ensures you remain compliant with Spanish tax laws while making the most of your financial opportunities. We also work with family offices and asset management professionals to provide high-net-worth expats with bespoke solutions for their investment management and long-term financial security.

Start Your Journey to Financial Freedom With Us NOW!

Navigating the financial and tax landscape in Spain doesn’t have to be overwhelming. With the right certified wealth manager or chartered financial advisor by your side, you can make informed decisions that maximise your investments, minimise tax liabilities and secure your financial future. Whether you need guidance on investment opportunities, wealth management or strategic asset allocation, our experts are here to help.

If you require advice, you can arrange a free initial financial consultation with a trusted expert on:

Telephone: +350 5600 5757

Email: connect@adviceforexpats.com